MARKET VIEWS

Posted 10/10/2015

The four most expensive words in the English language:

"This time it's different."

-Sir John Templeton

At the end of Q2, I started my most recent market commentary with the following observation: “Lets not sugarcoat it, there’s no easy way forward for highly uncertain markets in a highly troubled world….. the outlook for the second half of 2015 appears ominous and volatile.” And so it has come to pass.

The usual suspects did not disappoint: 1) the tenuousness and fragility of a viable Eurozone economy, first rocked by a near Greek bankruptcy and now buffeted by an inexorable immigrant refugee crisis; 2) the inevitable slowdown of China’s prodigious growth economy and the world’s increasing economic dependence on the Middle Kingdom; 3) the U.S. economy’s chronic anemic recovery and the Hamlet-like handwringing over the Fed’s impending interest rate hikes; 4) the continuing collapse of world oil prices and its devastating fallout on energy exporting nations and the overall commodities complex; and 5) the conflagration of terrorism, religious fanaticism, petulant Russian and Iranian nationalism, global deflation, etc. etc. More than ever, global equity investors must climb a dauntingly high wall of worry.

The global markets were slammed during Q3 and most investors probably wished they had just stuffed their money under their mattresses. For the quarter just ended, most major equity indices declined 7-10%, leaving the YTD results virtually all in “correction” territory for 2015. U.S. Treasuries and investment grade bonds were the beneficiaries of the flight to safety, returning 1.5% to 2.0% YTD. The conspicuous exception in the fixed income category was high yield bonds which turned in a disappointing YTD performance of -2.5%, in large part attributable to the big decline in issuers in the energy sector. During the first half of 2015, there had been a steady migration of funds out of the bond market into the equity markets in anticipation of the Fed’s plans to hike rates, but the market timers and asset allocators discovered that they were just too clever by half, as they were immediately subjected to the nerve-racking turbulence of equity-like volatility. It seems like cash is king only when everyone else is losing money.

During the last five years of this long bull market, central banks around the world have been cutting rates and providing stimulus, and that has been sanguine for the markets. But the capacity of the world’s central banks to deliver economic growth and support economic recovery is being called into question. This has depressed markets and heightened volatility. Moreover, concerns about China and other emerging markets have caused investors to take a more pessimistic view of market performance. Even in the U.S. where moderate recovery has been taking place for several years, the economic data was not deemed strong enough to give the Fed confidence to raise rates. In response to this tepid appraisal, the markets reacted badly and volatility has climbed to the highest level since 2011.

Global equities are down 13% from their recent peak in June, the largest fall since 2011. We face a murky period for the balance of 2015 and during the next six-month time horizon. In the meantime, markets will remain fragile and any negative news will be met with exaggerated selling pressure. So what is one to do in the intermediate term? In times when both economic growth is constrained and rising interest rates are imminent, asset class and geographic diversification remains paramount. The continuing strength of the U.S. dollar and the relative political stability of North America keeps us in the envied position as the world’s safe haven for investments.

Although recent market developments are unnerving, we have only incrementally increased our cash positions without dramatically altering our long-term investment positions. The U.S. markets still represents an attractive combination of moderate growth and stability, while Europe and Japan present selective opportunities for the value investor. On the fixed income front, we retain our longstanding overweight in investment grade bonds but have pared back our high yield bond exposure. Within equities, we are overweight in large-cap defensive names, including health care, pharmaceuticals and consumer non-discretionary businesses.

*****************

Bold and Boring….. Legendary investor George Soros once said: “If investing is entertaining, if you’re having fun, you’re probably not making an money. Good investing is boring.” I have met few professional investors in 2015 who are having fun, but the point is that we should constantly assess our fundamental investment thesis and be prepared for further trouble. It isn’t time for wholesale selling and hiding in cash, but we should adjust ourselves to a lower-return investment paradigm. This means staying defensive, highly liquid and maintaining a generous portion of cash in well-diversified portfolios. The investment world has always been a curious place and the impulsive sheep-like behavior of investors makes it even weirder yet. For contrarians and long-term investors, this curious state of affairs offers opportunities, just like in 2009 and again in 2011, with entry points into world-class business enterprises with reasonable valuations. We have been going through a market correction, albeit one occurring in the very late stages of an extended bull run. This time, it is still not different. Yet even with the recent market tumult, we remain steadfastly constructive on equities beyond the currently quarter, and look to find our thrills in other endeavors.

Posted 07/12/2015

I am just sitting here watching the wheels go round and round,

I really love to watch them roll.

No longer riding on the merry-go-round,

I just had to let it go.

-John Lennon

Imagine ..…. there’s no Chinese stock market bubble (there is), imagine there’s no Greek bankruptcy (there is), it’s easy if you try, no hell below us, above us only sky.

Lets not sugarcoat it, there’s no easy way forward for highly uncertain markets in a highly troubled world. After a promising start in Q1 (especially in Europe, China and Japan), the global equity markets, along with the debt markets, shifted into reverse in Q2, with the outlook for the second half of 2015 appearing ominous and volatile.

Blame it on the usual suspects: 1) Greece’s debt standoff throws into sharp relief the tenuousness of a long-term viable Eurozone economy; 2) the casino-like nature of the Chinese stock market, when mixed with the inevitable slowdown of the country’s prodigious annual growth rate and the excesses of its authoritarian command economy, hints at potential market debacles of troubling dimensions; 3) the U.S. economy remains mired in an anemic recovery and faces the impending prospect of interest rate increases; 4) the collapse of world oil prices continues to send ripples through the global economy, altering the fundamentals of both individual industries and countries; and 5) the specter of ISIS, horrifying terrorism and barbarism, a petulant Russia and Iran, among numerous other sources of market anxieties. But lets stop here lest one becomes too morose.

Suffice to say that global markets were severely whipsawed during Q2 and most investors felt stalemated by a wall of worry. For the quarter just ended, most major equity indices retreated 1-2%, leaving the YTD results virtually unchanged for 2015. Bond prices tumbled as well, sending the yield on the 10-year Treasury from 1.93% to 2.34%, the biggest single quarterly rise since the end of 2013 and snapping five consecutive quarters of falling yields. There has been a steady migration of funds out of the bond market into the equity markets in anticipation of the Fed’s plans to hike rates, just in time for investors to enjoy the nerve-racking turbulence of equity-like volatility. The old Wall Street cliches remain applicable: the grass is always greener on the other side (until you are on the other side), and be careful of what you wish for (you may not be so thrilled when it happens).

But like the song goes, although we get all kinds of warnings to save us from ruin, I’m feeling OK. I’m doing fine watching all the machinations of the various trading markets we are engaged in daily. We expect mediocre gains in stocks this year, helped by still low interest rates and modest economic growth. Valuations are quite full, but nevertheless far from historical extremes. Central banks around the world are cutting rates and providing stimulus, and that’s sanguine for the markets.

Ongoing efforts to restructure economies in key European markets and in Japan and China represent sources of optimism for 2015. The continuing strength of the U.S. dollar and the relative political stability of North America keeps us in the envied position as the world’s safe haven for investments. We are thankful to be protected by two large oceans, affording a buffer between us and the chaos of the world.

Although recent market developments are unnerving, we don’t think there’s a great hurry to dramatically alter our long-term investment positions. Truth be told, we have been rewarded for remaining equal-weight (sometimes even over-weight) in riskier assets and in holding steadfast to our diversified income-producing positions. The U.S. markets still represents an attractive combination of growth and stability, while Europe and Japan have improved to equal-weight status. On the fixed income front, we retain our preference for credit risk over interest rate risk, including our longstanding overweight in investment grade and high yield bonds. Within equities, we remain overweight in large-cap defensive and cyclical names, including health care, pharmaceuticals, media and technology.

*****************

Investing as a Phantasmatic Activity….. The world has always been a curious place and the behavior of investors have made it even weirder yet. This curious state of affairs offers opportunities to investors who are able to understand how these dynamics affect different asset classes and regions. We recognize that the investing world is not a zero-sum game. Often there is no symmetry between winners and losers, and market dynamics operate on its own idiosyncratic underlying logic.

For example, take the two major melodramas that have held global investors spellbound in recent weeks: the scenario of a collapsing Greece and the roller-coaster ride of the Chinese stock markets. The case of Greece is a tragedy scripted by Greek politicians who favor rhetoric and ideology over economic reality, corroborated by a Greek population that cannot bear the pain of austerity unless it is forcibly imposed upon them from the outside. The case of China is a hysterical replay of the American NASDAQ mania of 1999-2000 wherein greed and fantasy spirals out of control until most retail investors’ savings vaporize into thin air.

The idea of investing is a social construct that continues to change with each new market cycle. As a fundamental reference point, each investor has his own singular fantasy of “the Market,” an unconscious phantasm that influences his search for wealth and satisfaction. In this endeavor, he is shaped by the seductive influences of the group, one that typically operates on a surfeit of idealization, narcissism and insecurity. The search for and eventual loss of this ideal is present in both the Greek and Chinese examples as the harsh lessons of market reality lurches towards its inexorable conclusion. As is so often the case in investing fantasies, these too shall end in tears.

My current posture towards the prevailing market tumult and uncertainties is best captured this way:

People asking questions, lost in confusion.

Well I tell them there’s no problem, only solutions.

Well they shake their heads and they look at me as if I’ve lost my mind;

I tell them there’s no hurry , I’m just sitting here doing time…..

I just had to let it go, I just had to let it go.

Posted 04/12/2015

“In this world there are only two tragedies.

One is getting what one wants, and the other is not getting it.

-Oscar Wilde

Rethinking Fidelity ..…. Stocks in the U.S. and around the world finished Q1 2015 with modest gains, punctuated by record highs achieved in many markets including the U.S., the U.K., Germany, India as well as strong rebounds in China, Japan, France and Spain. Exceptionally low interest rates and central bank easing has diverted funds from both bonds and cash into riskier asset classes. Moreover, efforts to restructure economies in key European markets and in Japan and China represent new drivers of growth for 2015. The continuing strength of the U.S. dollar benefit companies with weaker currencies, thus contributing to the 22% surge in the German DAX, 16% rise in the Shanghai Composite and 10% increase in Japan’s Nikkei. Declining energy prices have also helped countries dependent on oil imports and boosted the fortunes of many consumer stocks.

Contrary to the trends of 2013 and 2014, the U.S. indices lagged its international counterparts. The stronger dollar has restrained the profits of the American multi-nationals that dominate the Dow and S&P. In addition, the advent of near-term interest rate increases and a fully valued stock market (P/E of 16.7 x forward earnings versus a 10-year average of 14.1x) has had a dampening effect on near-term investor enthusiasm.

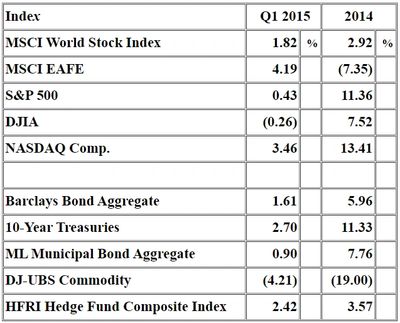

For Q1 2015, the MSCI World Index increased by +1.8% and the EAFE advanced 4.2%, as hopes brightened for a nascent economic recovery, particularly in Europe. Meanwhile, the U.S. indices treaded water as the Dow dipped (0.3)% and the S&P 500 edged up 0.4%. Most fixed income sectors continued to generate steady returns, as U.S. Treasuries keep serving as the world’s safe haven in times of volatility and political strife. Continuing the negative momentum of 2014, commodities, led by sagging oil prices, declined (4.2)% in the quarter.

The increasingly positive return prospects in Europe prompted by the massive devaluation of the Euro, and the structural reforms in Japan and China do not diminish the progress achieved in the U.S. since 2009. It just means that the rest of the world is catching up in terms of financial recovery and stabilization. The U.S. economy is increasingly on a self-sustaining path in 2015, and a respectable 3% growth in GDP is expected. Improvements in the credit markets, employment and lower energy prices should all result in moderate, positive implications for the U.S. indices.

With the benefit of hindsight, we have been rewarded for remaining overweight in riskier assets and in holding steadfast to our diversified income-producing positions. The U.S. markets still represents an attractive combination of growth and stability, while Europe and Japan have improved to equal-weight status. On the fixed income front, we retain our preference for credit risk over interest rate risk, including our longstanding overweight in investment grade and high yield bonds. Within equities, we remain overweight in large-cap defensive and cyclical names, including health care, pharmaceuticals, media and technology.

*****************

Can We Desire What We Already Have?….. Robert Plant (of Led Zeppelin fame) has said: “I know how to sing about love because love is the continual roller coaster. I feel the need for love, and I also feel the despair.” When our desires are unfulfilled, we feel a profound lack. When the object of our desire is a person, her absence leaves us feeling alone, desolate and unloved. However, fulfilled desire portends its own loss. Getting what we want undermines the thrill of desire. The sweetness of yearning, the strategies of pursuit, the phantasms of complete satisfaction often give way to the foreclosure of possession.

The grand illusion of love is that we think our partners are ours. In reality, their separateness is inevitable and their mystery essential to their desirability. As soon as we begin to understand this paradox, then sustained desire become a real possibility. There is nothing like the fear of loss to ignite fading desire.

But what does this meditation on love and desire have to do with that other compulsive act of desire - the pursuit of wealth and investment returns? The counterargument to the law of diminishing returns is the principle that consistent investment leads to increased satisfaction. The more we do something, the better we get at it, and the more we will enjoy it. The ongoing challenge for both romantics and investors alike is to continue to bring the erotic home - to confront the truth of our desire. In our love life and in our financial life, may we be permitted to experience small transgressions, illicit strivings, and passionate idealizations! Desire is fundamentally transgressive and we have to keep ourselves motivated and sufficiently hungry. Ultimately, in both realms, it is imperative that we work, if only to keep what may seem too easily available sufficiently elusive, and to stoke the embers of our desire - so that it does not extinguish in our hearts.

Posted 01/12/2015

“Every man has it in his power to magnify himself,

to multiply the ways in which he exists,

to make his life full, significant and interesting.

-Aldous Huxley

A New Beginning….. All in all, even with the many bumps in the road, 2014 turned out to be a year of progress and recovery for the markets. We have made an important transition from the financial crises and recession of the previous five years, positioning the financial markets for the next stage of growth. With the recent end of the Federal Reserve Quantitative Easing program, we have entered into a normalization of U.S. monetary policy. Coupled with the prospect of a moderately tightening interest rate environment and dramatically looser monetary policies abroad, U.S. markets enjoyed the largest and most broad-based rally in the U.S. dollar since the 1990s.

For 2014, the S&P 500 (reflective of large-cap U.S. corporate names) turned in the best performance among the major asset classes we routinely reference, running up +11.4% and outpacing the Dow (+7.5%). Outside of the U.S., equity performance was much more restrained, as the MSCI World Index increased by a tepid +2.9% and the EAFE declined -7.4%, dragged down by stagnant economic recovery abroad, political turmoil and a faltering Euro. Only China (+52.9%) and India (+29.9%) significantly outperformed the U.S. Most fixed income sectors generated sparkling and largely unanticipated strong returns, as U.S. Treasuries defied the skeptics and keeps serving as the world’s safe haven in times of great volatility and political strife. Commodities, led by plunging oil prices, pressured most commodity-sensitive local stock markets but may represent a longer-term catalyst for investment outperformance in 2015. Actively managed accounts continued to significantly lag the broader passive indices and ongoing hedge fund under-performance makes any reference to them as the “smart money” more and more oxymoronic.

The rebalancing and deleveraging of personal and institutional debt in the U.S. is well underway and American investors will benefit from the fruits of this transition while the rest of the world catches up in terms of financial recovery and stabilization. Thus we envision broader economic and earnings growth with an acceleration in Europe and Japan. The U.S. economy is increasingly on a self-sustaining path in 2015, and improvements in the credit markets, employment and lower energy prices will result in important positive implication for the markets.

Viewed through the perspective of recent turbulent geopolitical events in Europe, Russia and the Middle East, we have been rewarded for remaining overweight in riskier assets and in holding steadfast to our diversified income-producing positions. We maintain the thesis that the U.S. is still in the middle of a long, moderate economic expansion. The U.S. markets currently represents the best combination of growth and stability. We continue to overweight high yield bonds (excluding the energy sector) as they benefit from relatively attractive yield spreads, strong fundamentals, and lower exposure to rate risks. Within equities, we remain overweight in large-cap defensive and cyclical names, including health care, pharmaceuticals, media and technology. Outside of the U.S., we are strictly highly selective stock-pickers, maintaining positions in companies we believe have strong franchises and compelling long-term prospects. For fixed income, we expect 2015 to more resemble 2013 rather than 2014, with muted low single-digit returns.

*****************

Why I Keep Things Simple….. In our modern world, one-quarter of the world’s population owns smartphones. Nearly two billion people are on social networks. By the end of the decade, five billion people with 50 billion devices will be connected online. This exponential proliferation of mobile devices, social media and data technologies is transformative and yet has resulted in unprecedented complexity.

This accelerating complexity is the dominant issue of modern life, infiltrating our work, private life, our physical and psychic health and our personal relationships. Navigating all this complexity consumes an ever increasing proportion of our energies, time and financial resources. So how do we rise above this quagmire of complexity to distill a clearer, manageable form of simplicity?

One starts by redefining the way we want to be and how we want to function. Technology brings a plethora of data and information to our door but we can decide how to interact with it. The reality is that keeping things simple is very hard. It means constantly filtering out obstructions, distractions and superfluousness. Making the various parts of our lives work together and run smoothly requires a vigilance and practicality that is not easy to attain. But keeping things simple has amazing benefits: clarity, insight, serenity and, perhaps if we are lucky, freedom from want. Portfolio management is but a small paradigm in the larger fabric of our lives but the applications are remarkably similar. Financial independence does not come quickly but is, instead, predicated on the cumulative good habits of saving, investing and planning. These worthy objectives are predicated on the application of mindfulness, due diligence and discipline. In psychoanalytic terms, it means remembrance, repetition and working through. Isn’t it time to make it all work together to more easily control the complexity of our personal world? Without hyperbole or irony, if one simplifies everything, then one can do anything.

Posted 10/08/2014

“They say every man needs protection,

they say every man must fall.

Still I swear I see my reflection,

Sitting so high above the wall.....

-Bob Dylan

Markets are Diverging as Volatility Rises….. With Q3 2014 in the books, it is an apt time to assess where we stand so far and what the current 2014 year may mean for investors. With a near-term correction in the wind, the MSCI World Index and EAFE gave up ground in Q3 and are now showing a YTD performance of +2.3% and -3.6% loss, respectively. Commodities were the worst performers among the major asset classes in Q3, driven down by the lowest oil prices in two years as Brent crude is off over 20% from its February 2013 highs. Nervousness about the Federal Reserve’s scheduled end of economic stimulus in October has kept both emerging markets and developed markets on the defensive all year. In the U.S., the broad-based S&P 500 and NASDAQ Composite Index maintained respectable YTD returns of 6.7% and 7.6%, though little changed from mid-year levels. Among the major international equity markets, only China and India have been more robust. The bond market continues to represent the unexpected sweet spot in the marketplace, with prices moving higher and rates lower, even as the Fed continues to signal the advent of interest rate increases in 2015. It is noteworthy that the two best sectors YTD have been Treasuries and munis, and even more so on a risk-adjusted basis. These two traditional safe havens for risk-averse investors have represented the classic contrarian plays so far this year, outpacing most other major asset classes.

Against the backdrop of turbulent geopolitical events in Eastern Europe, Russia and the Middle East, global investors have been focusing on the efforts of the European Central Bank and the Federal Reserve to implement the right combination of accommodative policy actions to address sluggish growth and recovery. During the past five years, we have been rewarded for remaining overweight in riskier assets and in holding steadfast to our current bond and other income-producing positions. Now however, with a fully valued stock market and the prospect of rising interest rates in 2015, we are reducing our risk profile and starting to raise cash levels somewhat. Though our fundamental U.S. investment posture remains cautiously optimistic, we are now more inclined to protect YTD-gains and be more conservatively positioned for the remainder of the current year.

The U.S. markets currently represents the best combination of growth and stability. Reflective of this sentiment, the U.S. dollar has been hitting fresh two-year highs against the Euro and six-year highs against the Japanese yen. U.S. assets stand to benefit from regional political/economic strength and the U.S. dollar remains strong against most other currencies. We continue to overweight high yield bonds and floating rate leveraged loans, as they benefit from relatively attractive yield spreads, strong fundamentals, and lower exposure to rate risks. Within equities, we remain overweight in large-cap defensive and cyclical names, including health care, pharmaceuticals, media and technology. Our diversified positions in current income securities such as high yield bonds, REITs, MLPs, and high dividend stocks remain a bulwark against the fecklessness of ever changing market sentiment.

*****************

Day by day, O’ sweet Lord, to thee I pray….. With a new season comes new routines, new schedules and more anxieties. Many investors feel a surge of stress when faced with their new commitments and obligations. Our ubiquitous media channels constantly reminds us that the world - and therefore the investment landscape - is chaotic, dangerous and unpredictable. Risk is always lurking, like an impending viral outbreak, beneath the surface of our financial lives.

When I reflect on what the actual problem is, it boils down to a kind of ontological and financial insecurity. There is an underlying angst and pessimism that is palpable. Not much in our day-to-day lives can change in the short-term, but what can change is our perception as to what is already happening. Instead of squandering our energy lamenting what we lack, we can quietly focus on softening the resistances that prevent us from moving through each day with less of a struggle. First, stop competing with your colleagues and acquaintances and measuring yourself against them and their materialistic possessions. For the majority of us, financial independence does not come quickly but is, instead, predicated on the cumulative good habits of saving, investing and planning. It is difficult to build personal wealth and a sense of freedom if you have not taken the time to know what you want, define what is important, and then patiently work towards achieving those goals.

Neither ignore your investments nor obsess over them. The daily fluctuations of the stock market, the 24-hour news cycle and the parade of hyper-ventilating media punditry constantly threatens to inculcate us with their reflexive and myopic perspective of what we should do and fret over. Market sentiment and one’s sense of financial well-being, though transmitted via quantitative jargon, is inexorably psychological and therefore deeply subjective. Simply try to invest in things you can understand, and find a stable, trustworthy advisor to guide you through this process. Don’t be so scared of financial risk, and streamline the insidious complexities of modern life. Free yourself of clutter in all its forms. The urge to control our lives and our destiny is a seductive phantasm we all indulge in. Instead, accept the humility of life’s impenetrable uncertainties. Day by day, just invest in oneself and in one’s essential relationships, and realize that chance favors the prepared mind. Take care of your physical, emotional and financial selves. By doing so, you may find that - any day now - you shall be released!

Posted 07/08/2014

“Show me the meaning of the world

'cause I heard so much about it.

I don't want to live without it.

I want.....I want.....”

-The Pretenders

The Beauty of Low Expectations ….. is that one finds it takes much less to be happier. At the outset of the year, most market prognosticators forecasted a modest rise in equities and a volatile downward skid in bond prices. With the first half of 2014 in the books, the major equity indices have already achieved a reasonably credible performance for the year, with the MSCI World Index, EAFE and S&P 500 ending the quarter with YTD returns of 5.6%, 3.7% and 6.1%, respectively. The bond market continues to confound everyone, with prices moving higher and rates lower, even as the Fed continues to signal the advent of interest rate increases sometime in 2015. Corporate bonds are having their best year since 2010 as credit spreads have tightened steadily during the year to approach their post-crisis lows. It is quite rare to see both equity and bond markets moving up together in unison In perhaps the biggest surprise move, 10-Year Treasuries, along with the commodities sector, ares outpacing all other major asset classes.

The global economic recovery is proceeding in accordance with our thesis. We have been rewarded for remaining overweight in riskier assets and in holding steadfast to our current bond and other income-producing positions. Not only has global equity indices moved steadily higher but a contraction in credit spreads have resulted in incremental capital gains in our bond and bond-equivalent holdings, In this kind of environment, finding extra return is more crucial than ever. In a low volatility, low interest rate environment, it is specific investment themes and catalysts that drive portfolio performance.With average YTD-gains across our various portfolios in the high single-digits, we are well positioned for whatever may occur in the second half of the year.

The global economy is on track to grow approximately +3% in 2014 and global monetary policy remains highly accommodative. We continue to overweight high yield bonds and floating rate leveraged loans. Within equities, we remain overweight in U.S. equities, especially in large-cap defensive and cyclical names. U.S. assets stands to benefit from regional political/economic strength and the U.S. dollar remains strong against most other currencies. Our long-term positions in health care, consumer discretionary, media, information technology and energy have been highly profitable. Finally, our long-established, diversified positions in a range of current income securities such as high yield bonds, REITs, MLPs, and high dividend stocks have reaffirmed our strategy to be simultaneously defensive and opportunistic.

*****************

Why Everyone Eventually Becomes Themselves ….. While most investment professionals strive to project a persona of omniscience and swagger to outsiders, the fact that they are inescapably below average is both a widely verified empirical conclusion and a telling statement on the nature of the investment process. The investing profession is much more marked by failure than by success.

Behavioral finance has posited several hypothesis why investors gravitate towards poor performance: overconfidence, unrealistic expectations, excessive trading and irrationality all play a role. However, regardless of the reasons, any normal distribution of a large sample of professional investors will yield roughly the same proportion of overachievers, underachievers and a large majority who cannot rise above a statistical regression to the mean. Yet all the academic research studies have little to say about the most crucial element in this widely pursued task. Professional investing is fiercely competitive, so any advantages are quickly eroded by imitation. Outstanding investment returns are never solely the result of some proprietary investment methodology. The ubiquitousness and instant accessibility of market information renders investing by formula an exercise in predictability. Instead, exceptional performance is more likely the result of an alert, curious and flexible mind, one that is comfortable with a certain kind of risk. Such a mind has faith in the redemptive capacity of the imagination and usually winds up upending conventional thought. Investing is at heart an entrepreneurial endeavor that is both essential, non-quantifiable and incalculable. No one can really identify in advance who can do it well in and no one really understands precisely why. Most investors, like most people, are obtuse conformists rather than original thinkers. In the same way that most people are ill-suited as entrepreneurs, so most are mediocre investors. Indeed, there is something patently infantile about the whole investing mentality but such insight neither alters investor sentiment nor behavior. That’s why it is so important for those who aspire to exceptional outcomes to take seriously the exhortation to think different. Think different. Act different. Once you have tasted the change, you won’t want to live without it.

Posted 04/08/2014

“I took a test in Existentialism. I left all the answers blank and got 100.”

-Woody Allen

Better Than Nothing ….. If one awakened from a bitter winter’s hibernation, it would be plausible to conclude that in Q1 2014 nothing happened. The major equity indices are essentially flat, with the MSCI World Index, EAFE and S&P 500 ending the quarter at 0.8%, 0.0% and 1.3%, respectively. The bond market continues to confound everyone, with prices moving higher and rates lower, even in the face of the Fed’s scheduled tapering program. In another surprise move, the long moribund commodities sector staged a 7% rally, outpacing most other major asset classes during the quarter.

However, a more nuanced analysis of Q1 reveals, not the somnolent inactivity of a trendless equity market, but the anxious dithering of a schizoid personality. January’s scheduled tapering triggered a hysterical sell-off in emerging markets. February rebounded as 2013 Q4 earnings calmed traders’ nerves. Finally, in March, the geopolitical events in the Crimea and Chinese currency concerns kept the broad indices bouncing in a narrow range. Both individual asset classes, as well as individual stocks exhibited low correlation with each other. In such a market environment, it is specific investment stories and catalysts that drive portfolio performance.

With modest gains across our various portfolios, we are comfortable with our current investment posture, perhaps best summed up as “better than nothing.” That so-called nothing is the infinitesimally small return on cash holdings which only looks prudent when the periodic paroxysm of market panic emerges. A tad better than nothing is the stingy returns from most fixed income sectors, which when risk-adjusted, may not even be able to make that claim. With a few exceptions, bonds seem frightfully over-priced and can make stocks seem like a risk-off trade.

Even though the equity markets, certainly in the United States, are fully valued, there are still numerous specific companies, industries and investment themes that justify continuing exposure. With the recent under-performance in emerging markets, there are certainly more opportunities in those sectors as well. Relative valuations compared with other asset classes, especially the fixed income sector, remain constructive for stocks and the positive momentum should persist through 2014. The global economy continues to heal and global monetary policy remains highly accommodative. We continue to shun most fixed income sectors except high yield and floating rate leveraged loans. Our thesis for equity returns in the mid-single digits remains intact. The emerging markets, the only region to suffer negative returns in 2013, should bounce back moderately in 2014. Within equities, we continue to overweight the U.S. and have reallocated funds back into some European names but remain underweight emerging markets. In spite of the bounce in commodities, we are still not enthusiastic about a general reentry, with the exception of specific niche commodities such as livestock, coffee and palladium.

U.S. assets continue to benefit from regional political/economic strength and the U.S. dollar is likely to remain strong against most other currencies. In Asia, we maintain exposure to Japan while being short the yen, are constructive on the secondary Southeast Asian markets, favor Germany among the European markets and believe Mexico can reform itself back into investment credibility. Our long-term positions in defensive large-cap U.S equities, particularly health care, consumer discretionary, media and information technology, have proven highly profitable. In international markets, our positions in Macau gaming companies, the Chinese internet sector and selective European luxury goods companies afford us diversification and the prospect for above-average gains. On the current income side in Q1, REITs and mortgage REITs gained 8.6% and 11.2%, respectively. Overall, our long-established positions in a range of current income securities (including high yield bonds, REITs, MLPs, and high dividend stocks) permit us to both eat well and sleep well.

*****************

Why Managing Clients’ Money is Such an Existential Experience ….. The truth about the investment business is that it is all about the left side of the brain (the rational, calculating side) negotiating with the right side (the emotional, aspirational side). The primary risk in investing is to avoid investment catastrophe and thereby the dubious career-ending distinction of looking stupid. This is precisely the reason professional investors are ruthlessly assiduous about the moves of other investors. To miss out on a big market move, regardless of investment fundamentals, carries the horrific risk of being fired. Yet, it is forgivable to be wrong, so long as one’s herd-following brethren are similarly guilty. This single dynamic always dominates the investing process, overemphasizes the short term, and ultimately leads to investment bubbles. There is something patently infantile about the whole investing mentality but that insight neither alters investor sentiment nor behavior.

It is precisely because the markets are volatile, sometimes inefficient, and “fair value” is an insidiously subjective definition, that security prices always trade far above and below what is retrospectively determined as a fair price. It is not surprising that investing can sometimes feel like an existential exercise. We are free to behave like a sage, a machine or a fool. Our decisions have immediate inescapable consequences that are our sole responsibility. We often do not know what is “right” but nevertheless feel compelled to act. In moments of great market turbulence, we often feel quite alone, doubting and rationalizing our positions. Market anxiety and insecurity are never far from our minds.

In recognition of this conundrum, professional investors manage market uncertainty and irrationality by consciously building in a generous “margin-of safety” in stock selection, maintain reasonable portfolio diversification and cultivate a long-term perspective. Year after year, investment success may thus be defined as earning an incremental year of our clients’ patience and trust. That is what makes our work meaningful.

Posted 01/08/2014

“I must come to the place where the id was.”

-Jacques Lacan

Resilience and Recovery ….. Call it rational exuberance or just defiant relief, the global equity markets (ex the sluggish emerging markets) powered to new highs as 2013 proved to be the best year for stocks since 1997. For 2013, equities were the only major asset class that delivered positive returns. The MSCI World Index, EAFE and S&P 500 achieved impressive returns of 24.1%, 19.4% and 29.6%, respectively. Bonds, pressured by the anticipated end of the Fed’s quantitative easing, along with commodities, remained in the red throughout the year.

Equity valuations rose substantially in the developed markets over the past year and the positive momentum should persist into 2014. Relative valuations compared with other asset classes, especially the fixed income sector, remain constructive for stocks. The global economy continues to heal and rising interest rates in the U.S. are a foregone conclusion in the coming year. Although global monetary policy will remain highly accommodative, the advent and timing of tapering will contribute to volatility and headwinds for global asset markets. As a result, we continue to shun most fixed income sectors except high yield and floating rate leveraged loans. Our expectations for equity returns in the mid-single digits are decidedly modest while the composition of stock market returns should be more balanced across geographic sectors. The emerging markets, the only region to suffer negative returns in 2013, should bounce back moderately in 2014. Within equities, we continue to overweight the U.S. and Japan, will reallocate funds back into some European names but remain underweight emerging markets. In our opinion, it is still too early for reentry into commodities.

U.S. assets continue to benefit from regional political/economic strength and the U.S. dollar is likely to remain strong against most other currencies. In Asia, we have increased exposure to Japan while being short the yen, favor Germany among the European markets and believe Mexico can be a dark horse emerging market contender in the coming year. Heading into 2014, our long-term positions in defensive large-cap U.S equities, particularly health care, consumer discretionary, media and information technology, have proven highly profitable. In international markets, our positions in Macau gaming companies, the Chinese internet sector and selective European luxury goods companies afford us diversification and the prospect for above-average gains. Finally, as bonds remain fraught with risk and cash still yields zero, our established positions in a range of current income securities (including high yield bonds, REITs, MLPs, and high dividend stocks) represent a reasonable risk-reward profile.

*****************

Investments and Desire ….. Alongside portfolio management, the one other professional interest that has engaged me intellectually through the arc of my adult life has been the theory and practice of psychoanalysis. In recent years, as I have ventured formally into psychoanalytic training, I have been struck by the many analogous parallels between the two professions and how they are both mutually edifying. In the investment world, we are constantly faced with overcoming irrationality, inconsistency and incompetence in the ways we arrive at decisions and choices when faced with stress and uncertainty. We cope with incessant volatility and the unpredictability of short-term market movements. Although many of our emotional and cognitive errors are known and predictable, we keep repeating the same mistakes.

The psychoanalytic meaning of our investing mentality can help us understand our unconscious motivations and the subjective perceptions of our own experiences in the reality of the marketplace. The unconscious is not a primitive part of the mind separate from the conscious, rational ego but rather a formation as complex and structurally sophisticated as consciousness itself. Our behavioral, cognitive and emotional habits can be broken down into their components and modified in accordance with our objectives. Understanding our most entrenched habits jolts us out of our ruts. However, mere information is not enough. We do not behave badly, irrationally or inefficiently because we lack information about our flaws; we have simply fallen into a pattern of thought or behavior which we are unable to alter.

The concept of desire - a fundamental and unfulfilled psychic need - is central to both psychoanalytic treatment and investment success. Lacan’s observation regarding the nature of desire and knowledge is equally applicable to emotional insight and investing effectiveness: “the psychoanalytic discovery of desire provides the subject with his moorings and reference points, signs identify and orient him; if he neglects, forgets or loses them, he is condemned to err anew.”

Our human nature draws from many hidden reservoirs of experience that require constant shaping and prodding to change. The aim of psychoanalysis is to lead the patient to uncover the truth about his or her desire, but this is possible only if that desire is recognized and articulated. The aim of successful investing is to satisfy the investor’s need for money, control and self-affirmation. In both cases, the objective is to bring such desire into our conscious reckoning, and via the process of remembering, repetition and working through, offers the hope that it may yet be realized.

Posted 10/08/2013

“Lately it occurs to me, what a long strange trip it's been.”

-The Grateful Dead

Small is Beautiful ….. In an unexpected defiance of the summer correction in the fixed income and credit/ liquidity sensitive sectors of the market, global equity market indices have continued to power ahead to new recent highs. The psychological albatross of “tapering,” or the incremental unwinding of the Fed’s quantitative easing program of recent years, seems to have been priced in by market participants. The unanticipated delay of Fed tapering, in tandem with the very complex and confusing macroeconomic and political issues confronting institutional investors, have not prevented them from remaining exposed to equities. In fact, through the first nine months of 2013, stocks have been the only major asset class that has delivered positive returns. Market bears, skeptics and the hedge fund sector have all badly lagged equities. Year-to-date, the MSCI World Index, EAFE and S&P 500 have achieved returns of 15.3%, 13.4% and 17.9%, respectively. Staying bearish, neutral or cynical has been a costly posture in 2013, or more precisely, too smart by half.

The global economy continues to heal and rising interest rates are an inevitable result at some point in the near future. As a result we continue to stay away from most fixed income sectors and favor stocks over bonds. We fully expect divergent performance across geographic regions and industrial sectors and therefore maintain sizeable cash balances across our portfolios. Within equities, we continue to overweight the U.S. (S&P +17.9%) and Japan (Nikkei +39.1%) for their safe haven status and have edged back into European names within the most recent quarter as the worst scenarios in Europe seem to have run its course. However, our enthusiasm is markedly restrained since we believe the equity markets are fully valued. Simply put, stock prices have been rising because investors have accorded higher P/E multiples to stocks while company earnings have been growing at a very modest rate. While this is understandable when bonds are fraught with risk and cash yields near zero, the prospect of the end of P/E multiple expansion presents a recurring concern.

So why do we not fear that a bear market is imminent? Signs of a market top are historically accompanied by over-leverage and frothy investor sentiment; we are not currently afflicted with either of these conditions. Rather than perverse exuberance, many investors exhibit varying degrees of anxiety and paranoia. Many corporate CEOs are wary of the sustainability of the recovery and have reacted accordingly. As we have noted throughout the year, psychologically speaking, we have been witnessing one of the most dispirited market rallies in recent memory. As for leverage, corporate balance sheets are laden with cash and individual investors are much more conservative with leverage relative to prior market cycles.

Truth be told, it is the persistence of so many unresolved risks that prevents us from lapsing into complacency. The threat of Fed interest rate tightening, the sluggish growth of emerging markets, the chronic structural problems of the Euro-zone and the intractable dysfunctions of Washington all put a continued bull advance into question. As a symptom of the “new normal,” we are prepared for a continuation of short-term volatility on all fronts. Perhaps continuous investor anxiety is simply the financial (and psychic) cost of being in the markets.

In our last quarterly report, we noted that the early-summer sell-off in stocks and bonds may have created an interesting entry point for U.S. equities and high yield bonds. In the ensuing months, these asset categories have responded positively. U.S. assets continue to benefit from regional political/economic strength and the U.S. dollar’s status as the world’s reserve currency, especially during periods of politico-economic turmoil in other markets. In comparison, we remain neutral on the emerging markets, most commodities and currencies.

For the balance of 2013, our long-term positions in defensive large-cap U.S equities, particularly health care, consumer staples, media and information technology, have proven robust. In international markets, our smaller positions in Southeast Asia and selected holdings in China continue to afford us diversification and the prospect for above-average gains. Finally, even in the aftermath of the rout in bonds and bond-like stock surrogates during June and July, the search for yield remains a dominant theme for investors. Our established positions in a range of current income securities (including U.S. high yield bonds, REITs, MLPs, and high dividend stocks) still offer a reasonable risk-reward profile in the prevailing zero interest rate environment. Amidst all the noise, the patient, diligent search for value remains rewarding.

*****************

How We Change ….. As investors and traders, we are constantly faced with overcoming irrationality, inconsistency and incompetence in the ways we arrive at decisions and choices when faced with stress and uncertainty. We have to cope with incessant volatility and the unpredictability of short-term market movements. Since many of our emotional and cognitive errors are known and predictable, how can we change them? This is neither an unanswerable question nor a quixotic motive.

Our behavioral, cognitive and emotional habits can indeed be broken down into their components and not only lead to individual change but broader implications as well. Understanding our most entrenched habits jolts us out of our ruts and makes us realize that we often do have a choice. However, mere information is not enough. We do not behave badly, irrationally or inefficiently because we lack information about our flaws; we have simply fallen into a pattern of thought or behavior which we are unable to alter.

Our human nature draws from many hidden reservoirs of experience that require constant shaping and prodding to change. If we begin to behave a little differently, we will start to think a little differently. In a conspicuous reversal of accepted wisdom, why not start with the superficial and see how it affects the profound? Take small, measurable steps and allow ourselves to be lured into minor successes. Small is beautiful!

Posted 07/10/2013

“Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ.

Once you have ordinary intelligence, what you need is the temperament to control the urges

that get other people into trouble.”

-Warren Buffet

Stay Calm and Carry On ….. For the first six months of 2013, the major U.S. equity indices turned in their best performance since 1999, although the lion’s share of these gains occurred in Q1. The rest of the world equity markets continues to trail the U.S., especially the emerging markets which declined over 14% YTD, highlighted by the -22.1% freefall in Brazil’s Bovespa, Russia’s drop of 15.8%, and the -12.8% decline in China’s Shanghai Composite index. Among the major world indices, only Japan’s Nikkei’s 31.6% gain outpaced the S&P 500.

Strange as it seems, most investors, rather than feeling elated or relieved, exhibit varying degrees of panic and anxiety. Psychologically speaking, this has been one of the most dispirited market rallies in recent memory. Financial markets experienced dramatic turbulence in June not seen since the height of the eurozone crisis. Since the market’s recent highs in late May, virtually all assets have underperformed cash. Asset diversification has proved futile as all asset class – stocks, bonds, credit and commodities - have fallen markedly. The culprit, of course, was the sharp rise in U.S. real interest rates. While the path of U.S. bond yields has become critical to the fate of risk assets worldwide, divining the market impact of U.S. monetary policy remains frustratingly more art than science. We should therefore prepare for a continuation of short-term volatility on all fronts.

With the Fed about to embark on incremental tightening of monetary policy, the recent sell-off has created an interesting entry point for U.S. equities, high yield bonds and the U.S. dollar. Due to favorable economic growth and a responsive central bank, U.S. assets continue to benefit from reasonable valuations and regional political/economic strength, especially compared to other major markets. Simply stated, the U.S. is further along in its recovery from the recent recession than Europe and other regions. Aside from remaining overweight on Japanese equities, few other sectors seem inviting as we head towards a changed environment of reduced stimulus and declining consumer confidence. At present, we are bearish on Australia, Canada Brazil, Russia and other commodity-based economies as well most commodity classes. In the Chinese market, the consequences of systemic deleveraging continue to threaten the country’s financial stability and we thus advise caution as well.

In 2012 when the preponderance of the positive action took place in Q1 and the balance of the year was spent in a narrow fluctuating range, we expect a somewhat similar scenario for the balance of 2013. We still like defensive large-cap U.S equities, particularly health care, consumer staples, media and information technology. In secondary markets, we continue to like the investment profiles and diversification in the smaller Southeast Asian economies including Singapore, Thailand, Malaysia, Indonesia and the Philippines.

In spite of the rout in bonds and bond-like stock surrogates during June, the search for yield remains a dominant theme for most investors. Our established positions in a range of current income securities (including U.S. high yield bonds, REITs, MLPs, and high dividend stocks) have generated not only generous current income but equity-like capital appreciation as well. While we did not anticipate the sudden spike in rates in June, these holdings still offer a reasonable risk-reward profile in the prevailing zero interest rate environment.

*****************

Koan: a story, dialogue, question or statement, the meaning of which cannot be understood by rational thinking but may be accessible through intuition ….. In the midst of market tumult, why is it sometimes better to do nothing than to do something?

A fundamental part of the lore of Zen, a koan is not an unanswerable question or a meaningless statement. Instead, it confounds the habit of discursive thought and shocks the mind into awareness. To cope with the incessant volatility and unpredictability of short-term market movements, one might best be seated in the midst of a trading floor or be far removed physically from the markets, or both. To prevent investment calamity, professional investors are obsessed with what other investors are doing. What terrifies the professional investor is not being wrong, but being wrong alone. This syndrome creates a herd mentality that regularly drives prices far above and below reasonable levels. Of all the market inefficiencies, this is the most dominant and insidious. The short term will always be exaggerated. Resisting the siren call to NOT sell into a market panic or to NOT buy too early is often the most stringent test for a long-term investor.

Warren Buffet’s adage is that investing is simple but not easy. It is simple to conclude what should be done but not easy to actually implement it. While Wall Street pundits always (and pathetically) wants you to believe how nimble and prescient they are, it is far more critical to maintain and articulate one’s own informed viewpoint about the current investment situation. To help myself keep a long-term perspective, I have a 100-year chart of the Dow Jones Industrial Average taped next to my trading screen. Sometimes, stoically ignoring the furious up-and-down market movements of the moment and the resulting herding that they create is the only rational response against either bull market or bear market irrationality.

So keep calm and carry on!

Posted 04/08/2013

“Up, up, up, up

Down, down, down, down

In the end, it's only round and round”

-Pink Floyd

We Are Driven ….. Driven by expansive monetary policy of major central banks, global financial markets resumed a “risk-on” posture during Q1 2013. Although fundamental economic data continues the pace of moderate recovery from the prior year, there also appears to be a distinct re-pricing of global risk factors that have attracted investors towards embracing equities and other so-called risky assets. Although there are no shortages of political and financial flashpoints, outside of the impending serial train wrecks that loom in the Euro-zone, investors have concluded for the time being that other identifiable risk issues are idiosyncratic to particular countries and industries rather than systemic problems. This sanguine attitude lifted equity indices in the U.S. to all-time nominal highs by the end of the Q1. Stocks surged past all other major asset classes, fully recovering from the Great Recession of 2008. The S&P 500 vaulted 10.0% for the quarter, followed by the MSCI World Index’s gain of 7.2%, far outpacing the 0.1% loss on bonds and the 1.1% decline in commodities. In the U.S., the cost of hedging against market risk and market volatility has hit the lowest point in over two years.

Despite the outbreaks of crisis in the Euro-zone and fiscal/monetary miasma in Washington, investors have evidently concluded that the relevant risk environment is containable for 2013, thereby justifying a constructive investment posture for the next few quarters. At the beginning of the year, we targeted high single-digit returns for equities as an asset class. After three months, we are already there. Still, we are reluctant to raise our targets by more than a few percentage points. Remember that in 2012, most of the positive action took place in Q1 and the balance of the year was spent in a narrow fluctuating range. We still like defensive large-cap U.S equities, particularly health care, consumer staples, media and information technology. We continue to find attractive blue chip emerging market names that are fundamentally cheap and exhibit strong growth potential. In secondary markets, we like the investment profiles and diversification in the smaller Southeast Asian economies including Singapore, Thailand, Malaysia, Indonesia and the Philippines.

Since the advent of the Fed’s quantitative easing program, the search for yield has been a dominant theme in financial markets. For the last five years, our positions in a range of current income securities (including U.S. and foreign high yield bonds, mortgage REITs, MLPs, and high dividend stocks) have generated not only generous current income but equity-like capital appreciation as well. While we recognize that we are in the later innings of this particular investment strategy, in our view, these holdings still offer a reasonable risk-reward profile in the prevailing zero interest rate environment. The incremental yield in these segments provides a sufficient buffer for the credit risks incurred. Aside from a short position in US Treasuries, we have exited most of our other non-credit sensitive fixed income investments.

Against the tumultuous financial backdrop of recent years, the U.S. market is once again in its familiar position as the dominant safe haven for global investors. The U.S. represents the largest equity and corporate bond market in the world, with American stocks accounting for one-half of the MSCI World’s investable market capitalization. The U.S. dollar is still the world’s reserve currency and accounts for 70% of international trade. As the BRIC nations each face their own domestic growth issues, and the Euro-zone remains stuck in crisis, it becomes easier to understand why the price of U.S. Treasury securities remain buoyant despite pitifully low yields, and the U.S. dollar continues to hold its own against the euro and the yen, two currencies we are bearish on. For the time being, there are good reasons to be overweight U.S. equities.

*****************

The dark side of the moon …..The recent surmounting of nominal all-time highs in the DJIA and the S&P 500 indices made for arresting one-day headlines and gave the market pundits something new to opine over. However, there was little joy on either Main Street or among the greater investing public. Why is there such a disconnect between an important (at least technically) market milestone and the primal reactions of investors?

First, it is important to note that the new highs merely represent where the broad market indices were over five years ago just before the advent of the Great Recession. In fact, today’s levels approximate where the equity markets were in 2000 prior to the bursting of the Internet bubble. So in thirteen years, investors have endured two brutal bear markets interspersed with several interim bull markets. Thirteen years of running in place hardly merits a celebration!

Second, the news is actually worse than it appears. Since 2007, the inflation-adjusted real returns for stocks reflect an approximate 10% loss and, of course, even worse when extrapolating back to 2000. When including the fair market value of most Americans’ other primary source of wealth - their homes – the average net worth of over 90% of American households have declined by 25% in the new millennium. For many, it was indeed a “lost decade.”

Finally, most individual investors retreated to the sidelines during 2008-2009 and are now only starting to reallocate funds back into equities. They missed the bulk of the market’s recovery during the last four years and now are in a panic lest they fall further behind. It is a perennial question for market historians as to the real significance of large scale participation by small investors in the equity markets. In the past, such a development has often signaled a market top. Markets, in the short and intermediate term, are driven by investor sentiment. More specifically, bull markets are driven by an innate sense of optimism, even if we may be heading towards the dark side of the moon. …..In the end, it’s only round and round.

Posted 01/08/2013

“When we have money we can more readily obtain whatever else we have occasion for,

than by means of any other commodity. The great affair, we always find, is to get money.”

-Adam Smith

Now On Sale: Peace of Mind ….. Extraordinary and sustained worldwide central bank stimulus lifted global equity markets in 2012, with stocks surging past all other major asset classes. Despite persistent market volatility and investor jitteriness, global equity indices are poised in 2013 to fully recover from the Great Recession of 2008 and surpass their former all-time highs. As central bankers pushed investors into riskier assets, the MSCI World Index, the EAFE and the S&P 500 all rose +13%, outpacing the 4.2% return on bonds and the -1.1% retreat of commodities. Although chronic macroeconomic concerns regarding the Euro-zone sovereign debt crisis, the slowdown in China and the fiscal cliff in Washington remain unabated, the diminished fears of a backslide into widespread recession and a voracious appetite for current income investments have lured investors back into more speculative risk assets.

Despite the continuing nerve-wracking antics of Washington politicians, it appears that the “fiscal cliff-can” will indeed be once again “kicked down the road,” thereby limiting its negative near-term impact on the American economy. A slow recovery in Europe and a reacceleration of growth in China and other emerging markets make us take a constructive albeit restrained investment posture for 2013. We are targeting high single-digit returns for equities as an asset class, in line with a historically reasonable market valuation and an equal-weight allocation relative to investors’ respective benchmarks. We are now biased toward defensive large-cap U.S equities, still cheap emerging market stocks and will even nibble on some bargain-priced European blue chip companies.

The search for yield remains a dominant theme in financial markets. As Treasury bond yields stay artificially low for the foreseeable future, investors will continue to reallocate funds into investment grade and high yield bonds of dollar-denominated and emerging market issuers, as well as into various forms of high dividend stocks. Aside from a short position in US Treasuries, we maintain a hold position on most other fixed income investments. In our view, the credit sensitive sectors of the bond market still offer a marginally reasonable risk-reward profile in the prevailing zero interest rate environment.

For the fourth year in a row, the hedge fund industry has left its investors feeling deflated. Hedge funds on average gained +3.4 % in 2012, far below the total returns of most benchmark equity indices. An overly conservative stance coupled with modest use of leverage accounted for this marked under-performance. The highly volatile twists and turns of 2012 also made it difficult for active managers to navigate and time their investment portfolio adjustments. As a result, many hedge fund managers took risk off the table at inopportune times and paid for it with mediocre returns. Although hedge funds have lost much of their seductiveness for investors in recent years, there is still a case to be made for cautious optimism. With the bond market arguably at the end of a multi-year bull market, commodities in retreat and cash equivalents generating zero returns, investors admittedly do not have a wealth of attractive investment options. Relative to passive investing, hedge funds represent the systematic pursuit of alternative or unconventional strategies without any artificial restraints. The best hedge fund managers compel investors to approach market risk, market-outperformance and volatility in a serious way, impelling us to think differently and creatively. Nearly everyone expects that 2013 will be replete with market volatility and uncertainty, making ongoing execution and risk management more crucial than ever. This is, after all, the raison d’etre of hedge funds; if the most informed, most motivated active investors are not up to the task, then who is?

*****************

Why are we in such a mess? …..Sometimes we are the prisoners of our own self-imposed ideologies. We want our financial markets and our governmental institutions to function rationally and efficiently, wherein incentives are reasonable and outcomes are predictable. However, this is rarely the case, as the Great Recession, the corruption of Wall Street and the dystopia of Washington all amply demonstrate. Despite the best intentions of politicians and regulators, we operate in an infuriatingly inefficient and irrational market environment. Nothing seems simple or linear anymore; everything has become complex, multivariate and relativistic.

In spite of our own nature, sometimes it is best to start over, to draw upon a clean slate once again. In the beginning, human beings originated in a mythological garden. Staying within this metaphor, let us heed Voltaire’s advice and tend to our own gardens. Such a focus not only clarifies our own efforts, it also has the salutary benefit of removing some of the noxious conflicts and distractions from our personal and work lives. By focusing our attentions on the relevant over the trivial, on the long term over the short term, on the whole rather than the part, then we may become more adaptive, more productive and more at peace with our surroundings. Someone told me today: “Worrying does not take away tomorrow’s troubles; it takes away today’s peace.” Viewing the financial markets and our own investment portfolios in this way engenders growth, sustainability and prosperity. It is not just the epitome of free market capitalism; it is the very essence of personal freedom.

Posted 10/08/2012

“When your partner is deeply distressed, depressed and in a dark mood

and offers to sell his share of business to you at a huge discount, you should buy it.”

-Barton Biggs

The rally is on but nobody is partying ….. A notably strong quarterly performance for risk asset indices in Q3 has brought the market to its highs of the year and close to the all-time levels attained five years ago just prior to the Lehman bankruptcy-induced financial crisis. For the 3rd quarter of 2012, the MSCI World Index and the EAFE both rose +6.1%, while the US equity indices were close behind with between +4 to +6% increases. Year-to-date, equity indices worldwide have posted very respectable returns, with the US-based S&P 500 and NASDAQ far ahead of the field. Yet the market remains fixated on macroeconomic headlines, particularly the ongoing Euro-zone sovereign debt crisis, a hard landing in China and the impending fiscal cliff in Washington that market fundamentals and corporate profits seem to have little effect on investor behavior.

Despite the +14.6% rise in the S&P 500 year-to-date, market sentiment is still cautious and dour, with many pundits hinting at an imminent market reversal. Perhaps the overwhelming reason few investors are feeling celebratory is that Main Street has been steadily withdrawing funds from the equity markets since 2008 and reallocating it to the fixed income sector or regrettably sitting on the sidelines in cash. While this tectonic shift in asset allocation has perceptibly boosted bond returns and reinforced the Fed’s ZIRP (zero-interest rate policy), the bulk of retail investors have missed out on the stock market’s strong rebound of the past three years. In spite of the slow American economic recovery, the US stock market continues to be the most stable, promising regional sector, offering safe haven status for anxious global investors.

It is very telling that the most sophisticated institutional investors (e.g. the hedge funds and the university endowment funds) are significantly lagging the major US indices. So far in 2012, hedge funds are only up an average of +2.6%. The major university endowment funds at Harvard, Yale and Stanford just reported unimpressive investment results for the fiscal years ended June 30, ranging from zero – 5% gains. Harvard and Yale have become models for their university peers, with strong historical performances based on heavy weightings in international markets and alternative investments in private equity and hedge funds while underweighting US stocks and bonds. So 2012 is turning out to be a strange year because even though the major indices are approaching all-time highs again, most retail investors and a large portion of the so-called “smart money” have not been along for the ride.

When it comes to investing, often simpler is better. A conventional 60/40 blend of US stocks and bonds has produced the optimal risk-adjusted return for 2012 to-date. Based on current year’s earnings estimates, stocks are approaching fair value. Meanwhile, the fixed income sector – encompassing Treasuries, corporate investment grade, high yield and emerging markets – continue to perform steadily.

As the fourth quarter now unfolds, several major forces are shaping the investment landscape. Balance sheet deleveraging in the Euro-zone and in the US Treasury and municipal debt markets continues to dominate the headlines. The Fed, the ECB, the Chinese central bank and other major monetary authorities are actively intervening to stimulate their respective domestic economies. Finally, political transitions in Europe, the Middle East and the American presidential elections are clearly influencing short-term market movements. These forces are now the most important drivers of market outcomes for the balance of 2012. For conservative investors, bonds and high dividend-paying stocks have provided the sweet spot in a yield-starved environment. For now, we see fewer macro-environmental event risks even though the overall economic and political outlook remains sluggish and uncertain. The absence of “bad news” may allow the current rally in risk assets to continue through the rest of the year.

*****************

Do Hedge Funds Really Earn Their 2 & 20? …..These days there are so many hedge funds pursuing a myriad number of investing strategies that it can be difficult to identify their common denominators other than they seemingly cater to the wealth of the inaccessibly elite and then typically charge a 2% management fee along with a 20% performance fee.

The preferred investment vehicle of the “smart money” crowd, hedge funds this year have conspicuously lagged the major passive equity indices. The average hedge fund has struggled to deliver the absolute returns they advertise, as a nervous range-bound market has rendered even the most veteran investors tentative and risk averse. Whenever the hedge fund industry trails its benchmarks, critics question whether the funds deserve to earn their generous management and incentive fees. After all, isn’t it far easier to pay an average management fee to a mediocre portfolio manager than to pay a rich premium to an under-performing hedge fund manager?

In a world where the returns of most risk asset categories are highly correlated, the most important advantage that hedge fund managers enjoy over traditional long-only managers is the freedom to ignore or bet against any given benchmark. While hedge funds offer the seductive siren of alpha (the excess return over a market return), what they really deliver is diversification away from beta (the volatility or riskiness of such same market return). In other words, in strong up markets, hedge funds should achieve a somewhat lower level of absolute returns because they are presumably hedging the market. Conversely, in a down market, hedge funds should meaningfully outperform the market by emphasizing capital preservation.

In any given year, what matters as much as absolute return is a hedge fund’s capacity to capture upside market movement while maintaining some downside protection. While many hedge funds do very little conventional hedging per se, it is the systematic pursuit of alternative or unconventional strategies without any artificial restraints that justifies the sometimes outsized compensation that the industry charges. It is less critical that a hedge fund outperforms or lags its benchmark indices in the short-term; what really matters over time is that the hedge fund manager persuades or compels investors to approach market risk, market-outperformance and volatility in a serious and transparent way. Insightful asset allocation and stock selection do drive portfolio results. The truly outstanding hedge fund managers impel us to think differently and creatively, and to be completely accountable for our investment convictions. When they are successful in doing so, that is when they truly earn their keep.

Posted 07/05/2012

“Bankers talk about meditation, writers talk about money.

Spirituality is expensive.”

-Erica Jong

Only those with money can afford to not think about it ….. A strong final week and month of Q2 brought some solace to what was otherwise a punk quarter for most risk asset indices. For the 2nd quarter of 2012, the MSCI World Index dropped -5.8%, the EAFE fared even worse down -8.4%, while the US equity indices fell between -3 to -5%. The market remains so fixated on macroeconomic headlines, particularly the ongoing Euro-zone sovereign debt crisis, a hard landing in China and the looming fiscal loom in Washington, that market fundamentals have been reduced to a mere sideshow.

Despite the respectable rise in the S&P 500 year-to-date, that benchmark index is at the same level as it was 12 months ago. Market sentiment cannot seem to get out of its own proverbial way and the overall investing environment continues to frustrate fundamental stock pickers. We will just have to wait to see if Q2 corporate earnings confirm the slow, jagged American economic recovery but the US market still seems to be the most stable, promising regional sector compared to Europe and the emerging markets, at least for the balance of 2012.

We continue to believe that the markets will remain range bound and any further gains for 2012 will be modest. Although the S&P 500 is virtually unchanged from twelve months ago, crude oil is 13% lower, commodities have plummeted 15% and the euro has weakened against the dollar by 12% during this time period. Based on current year’s earnings estimates, stocks are even a little cheaper than a year ago. Meanwhile, the fixed income sector – encompassing Treasuries, corporate investment grade, high yield and emerging markets – continue to perform steadily. Once again, even in an unpredictable, chaotic market environment, asset allocation does matter.