MARKET VIEWS

Posted 10/04/2010

“No one in this world has ever lost money

by underestimating the intelligence

of the great masses of the plain people.”

-H. L. Mencken

2 pi r: The Circularity of Market Sentiment…..A very strong equity performance in the month of September (for the statistically obsessed - the best September in 71 years) more than compensated for a dreary August, as the markets continued its range-bound action. Investor concerns over an imminent double-dip recession gave way to the hope that central banks around the world would do whatever was necessary to inject liquidity into the markets and be standby buyers of government securities. As a result, stocks rallied going into the close of Q3 and Treasury bond yields fell to the lowest levels since the depths of the recent financial crisis.

One step forward, one step back….so it went, both in August-September as well as from Q2–Q3. On a day-to-day trading basis, the markets have felt tumultuous but…..; for all the incessant sound and fury of the Wall Street punditry and blogosphere, after nine months of market action and anxiety, most major equity indices are still largely unchanged from the beginning of the year. Stealthily, the action in 2010 so far has been mostly in bonds, where the relative outperformance (especially on a risk-adjusted basis) has been breathtaking. High-dividend equities, particularly the entire MLP sector, have also fared well.

Given the high level of correlation in market performance for most asset classes during 2010, it has been difficult for investors to achieve much alpha or relative outperformance – the holy grail of active managers. Market sentiment in 2010 has been mostly held captive to macroeconomic concerns such as governmental fiscal policy, currency interventions and the still distressed nature of major sectors (e.g. housing, consumer spending) and basket-case debtor nations (e.g. the PIIGS or otherwise known as Portugal, Ireland, Italy, Greece and Spain). Since equity valuations are currently only slightly below historical averages, there does not seem to be any near-term catalysts to drive market performance much beyond the trading range that has been in place for most of 2010. One possible swing factor would be the mid-term elections in November where a decisive change-of-control in Congress might provide the impetus for a year-end rally.

Going into Q4, we continue to overweight emerging market equities and bonds and have a decidedly neutral posture towards the U.S. and other developed economies. Fundamental growth and capitalistic dynamism seems to have taken hold throughout much of the emerging market nations while the so-called First World economies remain mired in existential and economic angst. The major currencies including the US dollar, euro, pound and yen all remain challenged as their respective fiscal positions continue to deteriorate. In comparison, the prospects for the smaller currencies such as the Canadian dollar, Australian dollar, Brazilian real, Swedish krona and Norwegian krona are more attractive.

Within the U.S., we lean towards more defensive sectors such as utilities, healthcare and large-cap technology companies. Within fixed income, we still are constructive on investment grade and high yield bonds, scaling back on more interest-rate sensitive sectors including Treasuries and agency securities. On the commodities front, the precious metals complex of gold, silver platinum and palladium continue to provide an excellent defensive haven against the debasement of paper currencies and profligate fiscal policies in both the U.S. and the Euro-zone. Other agricultural sub-commodities such as sugar, cocoa, coffee and fertilizers have also provided interesting short-term trading opportunities.

Finally, we remain dumbfounded by the resurgent price of government bonds of the US, the UK, and other Euro-zone nations in the face of historically low yields. Apparently, after having been burned by nearly every other major asset category over the last two decades, institutional investors are now hiding out in the only supposedly safe havens remaining. This too will end in tears.

*****************

Learning from Sports Psychology…..Anyone who has closely followed sports stars have observed how some individuals maintain a physical and mental toughness late into a game, somehow finding a way to perform under the most pressurized moments. Alternatively, most other athletes may try just as hard, but their concentration and confidence flags just when crunch time arrives. The difference between performance under pressure and choking under pressure is receiving close scrutiny from both coaches and psychologists.

Sports training offer some interesting analogies for investing. Similar to market action, the context for athletic competition offers the outcomes of winning or losing, a degree of unpredictability and the phenomenon of momentum, all within limited timeframes. As in investing, since the outcome of a contest is dependent upon so many simultaneous variables that are not readily controllable, setting goals and implementing strategy is crucial to winning. Generally speaking, the more personal and specific the objectives, the more it will influence investment behavior. Just as sports psychology uses performance targets to improve an athlete’s results, such an orientation can also aid any given investment strategy.

In my last quarterly market commentary, I discussed the role of cognition in the maturation of an investor. Cognition is how our investing mind processes information. Clear simple strategies helps guide our efforts and protects us from our latent emotion-driven biases. In volatile environments, well established goals keep us centered to a long-term perspective; this also facilitates adjusting our behavior to varying time horizons such as the intermediate-term (monthly, quarterly) or very short-term (daily trading decisions). It is difficult to build wealth if you have not taken the time to set goals. Take the time to know what you want and how you are likely to attain them. Investing, like sports, is a game but with more lasting consequences.

Posted 07/06/2010

“The person who is slowest in making a promise

is most faithful in its performance..”

-Jean-Jacques Rousseau

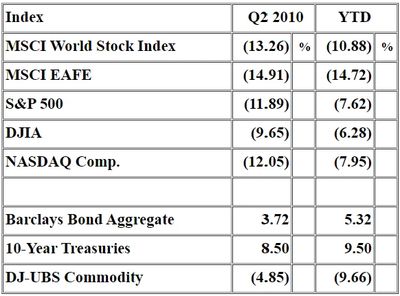

Double Dip, Double Trouble…..Investing in 2010 (just like 2009 and 2008 for that matter) traces an arc not unlike that of many individual lives: the happiness of profits builds slowly and inconsistently, and then the dread of loss comes without warning and all at once. On the dubious premise that nothing improves a bad mood like spreading it around, the recent outburst of negativity in May and June may be making global investors wallow in mutual empathy. The gnawing fear of a double-dip recession has taken the air out a nascent economic recovery and injected investors with a sobering dose of pessimism. Since reaching a year-high peak on April 23rd, the S&P 500 has tumbled into a freefall of 16%, rocked by Europe’s fiscal deterioration, fears of China’s slowing growth and an oil spill in the Gulf of Mexico seemingly resistant to either human or divine intervention. The ensuing panic quickly erased this year’s tentative gains and landed us deeper into bear market territory. Thus Q2 2010 snapped a four-quarter winning streak, with ominous repercussions as we head into the second half of the year. As in 2008, virtually all risk asset categories showed negative returns year to-date while U.S. Treasuries once again bask in the glory of its ultimate safe haven status. The yield on 10-Year Treasuries plunged to a 14-month low of 2.98%. What is the bond market signaling that equity investors don’t know?

Looking out into the second half of 2010, there is considerable uncertainty as to the nature of the next stage of this economic cycle. As a result, investors have been tormented by a seemingly schizophrenic market wherein risk-taking and risk-aversion alternate almost on a weekly basis. The broad equity valuations look reasonably attractive, now trading at 12.5x estimated 2010 earnings and only around 10x times what companies are expected to earn in the 2011-12 period, low enough to provide support even in the event of a lackluster economic recovery. On the immediate horizon, fiscal policy in the United States and throughout the major economies is at a critical juncture, providing the backdrop for any sustained broad recovery. However, with the return of volatility, it is prudent to maintain a defensive posture across virtually all asset classes. The room for positive economic and earnings surprises seems limited for the time being. Accordingly, we are taking on new positions only when a security shows exceptional valuation, credible growth prospects and attractive total return expectations. We favor defensive sectors that provide substantial dividends, a continued overweight in emerging market equities and bonds relative to developed markets, low-duration U.S. corporate debt, exposure to the precious metals group and higher-than-average cash levels.

We still believe that 2010 could result in a year of modest gains in the major benchmark equity indices, although investor expectations are diminishing rapidly. We prefer heretofore defensive laggards such as health care and utilities and continue to be selective buyers of emerging market equities on price declines. In the fixed income sector, we remain constructive on investment grade corporate and emerging market bonds, and are overweight the high-yield sector for its risk-adjusted total returns. We continue to hold a negative view of all the major developed currencies – the US dollar, British pound, Euro and Japanese yen – as they are afflicted with intractable debt burdens. A diversified basket of emerging market currencies as well as assets denominated in more fundamentally sound economies such as Australia, Canada and Scandinavia should outperform for the balance of 2010.

*****************

The Stoic Approach to Portfolio Management…..Most of the investment world seems to be populated by overconfident, hard-charging personalities who try to impress us with their expertise and swagger. They make daring predictions, sometimes achieve spectacular results but more often than not fade back into obscurity. However, when it comes to long-term success in investment management, it is sometimes advisable to follow those who exhibit the qualities of personal humility and intense intellectual focus. This is because trading markets are driven by a contrarian and unpredictable dynamic that often changes direction abruptly and turns conventional wisdom on its head. The markets are too fluid and multivariate to be rendered knowable, so investing is all about navigating uncertainty and managing risk.

An experienced investor devotes time and effort engaged in meta-cognition – or thinking about the nature and process of investing. He (or she) contemplates less about his strengths than his weaknesses, has a bias for caution, refrains from making predictions and does not multi-task distractedly when it is time to make decisions. Professional investors are constantly presented with theoretical models and formulas that provide the illusion of prediction and control. But we know that financial progress is most likely achieved through a series of successes and errors, to be improved upon in the next cycle. Anybody can collect data and analyze numbers, but the exceptional ones can also recognize the critical elements of timing and context. This type of skill requires patience and modesty, as if each market becomes imbued with its own feelings and motives. For the long-term active global player, the markets are complex beyond reckoning.

The Stoic approach to investing forgoes the manic crowd-following that animates so much of the day-to-day trading sentiment of institutional investors. When the market is macro-driven by major events and buffeted by ever shifting investor psychology, it is better to stay calm and flexible, using one’s proprietary intelligence and insights as much as possible. There is a time to be aggressive and a time to be defensive. Now is the time to buy slowly and knowledgeably, and hope that the markets will reward your decisions in a year or two. Such an approach is a wise and practical way to deal with the challenges of investing in the current environment.

Posted 04/05/2010

“If I seem unduly clear to you,

you must have misunderstood what I said.”

-Alan Greenspan

A Truncated V-Shape Recovery?…..The first quarter of 2010 provided a good indication of what lies ahead for the rest of the year: a jagged, halting economic recovery – but a distinct and perhaps sustainable one. The gargantuan relief rally that started in March 2009 when investors first concluded that Armageddon would be averted is poised to continue, marching in fits and starts to eventually one day retesting the all-time highs reached back in 2007. The charts of most stocks (and most risk assets) follow a tediously repetitive pattern: 12-month charts show a sharply rising line; but 3-year charts show a truncated V-shape, a precipitous ride down into the abyss and then a recovery that still remains well short of the original starting point. The art of charting constantly reminds its practitioners of two lessons: first, understand pricing history and second, the point of entry really makes all the difference.

After a tepid and aimless January and February, the U.S. equity markets posted an impressive performance in March 2010, with the benchmark S&P up 4.88% for Q1. But the positive market action was all compressed within a few weeks time and only underscored how rapidly investor sentiment can turn on a dime. The international indices, particularly in the Euro-zone and in commodities, were less robust.

On Main Street, most people are still grappling with the sobering realities of job insecurity, diminished household net worth and depleted savings. Although stabilizing, job creation, firm housing prices, and available consumer credit are still Washington policy goals rather than realities. However, the chasm between Wall Street and Main Street has never been wider. While the middle class grinds on amidst a prevailing sense of personal anxiety, the party was already getting started on Wall Street trading floors in mid-2009. Bonus expectations, client spending and risk-taking are quickly back to pre-recession levels. Hegel warned that “we learn from history that we never learn anything from history.” Alas, for those of us who have experienced several of these boom/bust cycles already, I caution that “the history of the stock market is the history of forgetting!”

That notwithstanding, the reason the financial markets are celebrating is because it is a discounting mechanism par excellence and it thinks it sees a sustained recovery 12-months hence. Corporate deleveraging and cost-cutting have created a scenario for a dramatic earnings rebound when demand returns. Extremely low interest and inflation rates continue to facilitate a return to normalcy. Accordingly, we believe that 2010 will result in a year of moderate follow-up gains in the major benchmark equity indices. We favor sectors such as technology, financials, commodities and energy that are most leveraged to economic recovery and capital spending. We also like heretofore defensive laggards such as health care and utilities.

We continue to be selective buyers of emerging market equities and cyclical commodity plays. We track closely the price movements of coal, iron ore, precious metals and base metals (e.g. copper, aluminum, and nickel) because they are reliable predictors of global economic demand and inflation. With each passing quarter, it becomes increasingly evident that the centers of economic and financial activity are inexorably shifting from New York, London and Tokyo to places like Hong Kong, Singapore, Mumbai and Sao Paolo. Beyond the BRIC countries, we continue to find attractive investment opportunities in other international markets such as Australia, Indonesia and South Africa. In the fixed income sector, we remain neutral on investment grade corporate and emerging market bonds, but continue to overweight the high-yield sector for its attractive risk-adjusted returns. On the negative side, we are short long-dated Treasuries, the Euro and afford most Euro-zone assets a wide berth.

*****************

“A Heartbreaking Work of Staggering Genius”…..At the end of calendar quarters, investment managers embark on the ritual ceremony of penning market commentaries for dissemination to their clients. These writings typically revolve around a somewhat formulaic review of any significant changes to the investment portfolio during the preceding three months, taking stock of any important macroeconomic events that occurred during the period. If the portfolio’s returns exceed the relevant benchmarks, it permits the investment manager to momentarily puff up his chest and make some self-congratulatory observations about his keen sense of market intelligence or timing. On the other hand, if the portfolio noticeably lags the benchmark indices, then there may be some self-effacing platitudes about the need for patience and the virtues of a longer term investment horizon. When it comes time to take the obligatory look into the market’s crystal ball, the writer may then revert to the utilization of investment clichés or any variety of banal, trite or insipid expressions that seem to flow freely from the pens and mouths of market sages, pundits and simpletons alike. The underlying theme of most market prognosticators is that when called upon to make a prediction, one can provide a number and a target date, just not necessarily in the same sentence or on the same page. A little ambiguity allows the reader to inject his or her own views into the commentary. In any case, a modicum of vagueness lets us live with each other’s differences of opinion and also mitigates the savagery of ongoing market debate.

By and large, none of this activity matters very much; for few investors actually read these quarterly missives and the authors themselves go about this task in a mechanical and benumbed state of mind. This is regrettable since, aside from the actual quantified investment returns, the quarterly market commentary is probably the most revealing evidence available to clients about their investment manager’s mindset and world view. The document not only sets forth what he thinks but, just as importantly, how he thinks. So much of short-term market action is chaotic and subject to such conflicting impulses that many market seers are “fooled by randomness.” They think they see patterns where there may only be statistical fluctuations. In any given short time duration, it is hard to discern genuine investment skill and prescience from sheer dumb luck.

So why is it worthwhile to render a close reading of your investment manager’s ponderings? I have an intrinsic interest in following those individuals who routinely invest large amounts of money, especially those who have exhibited an independent or contrarian streak that sets them apart from the large monolithic institutional behemoths. The hedge fund and private equity communities, as well as various activist investors and sector specialists, are typically individuals who are not only disproportionately incentivized to identify good investment ideas but also have “skin in the game.” Collectively, they are usually several steps ahead of the investing public and have a heightened sensitivity to market turns.

Perhaps the most important reason to read the public statements of those who manage your portfolio is that it helps you to know better the person to whom you have entrusted your hard-earned money. When portfolio values are rising, one is reluctant to make changes and it is natural for complacency to set in. However, during bear markets, it is difficulties that show what men are. Does your advisor understand adversity and how it should be handled? Does he possess the sensibilities to stoically carry on in the midst of fear and panic? Does he use intelligence to wisely deal with the ongoing challenges of investing? Read his quarterly client letters and decide for yourself.

Posted 01/06/2010

“From those who have been given much,

much will be demanded.”

-Luke 12:48

Counting Our Blessings…..The year that just ended was a very profitable year for most investors, assuming that one did not hide out on the sidelines since Q1 of 2009. ‘Take the money and run’ was not a smart strategy for investors stung by the heavy losses inflicted during 2008. Instead, the relief rally and hopes for a global economic recovery that emerged in Q2, Q3 and Q4 rewarded investors who faced the markets with a steady hand, a strong stomach and a modicum of conviction.

2009, one of the most volatile years in stock market history, was truly the year of living dangerously - replete with heart-stopping declines and breath-taking rallies. The 23.5% rise in the benchmark S&P index marked the best year since 2003, with the rest of the global equity markets reinforcing this hopeful sentiment. In a perverse mirror version of 2008, investors in most risk assets from emerging market equities to commodities to high yield bonds were richly rewarded, while those who sought safe haven in Treasuries were punished with losses of -10% or more and holders of cash got virtually nothing. Now commonly dubbed the “lost decade,” investors also just concluded the worst decade for stocks in 200 years as the S&P 500 Index actually lost 24.1% over the last 10 years!

For most people on Main Street, 2009 was a grinding year of personal anxiety, household downsizing, job insecurity and (for the least fortunate) outright unemployment. The gains on Wall Street were not in sync with the sobering, economic realities on Main Street. So which of these two parallel worlds really reflect what is happening in our economy? More importantly, will consumer sentiment or investor sentiment serve as the more accurate predictor of what lies ahead in 2010?

The answer to this somewhat rhetorical question is “Yes” on both counts. Although stabilizing, job creation, housing prices, consumer credit and real GDP growth will be slow and halting in 2010 and perhaps even through 2011. Our widely anticipated economic recovery will be jagged and take several years to offset the damage done by the Great Recession. There is a glaring dichotomy between the Wall St. economy and the Main Street economy. Nevertheless, the financial markets, still the most efficient discounting mechanism available to us, are already looking out 12-months hence and signaling a more sanguine longer-term verdict. Corporate deleveraging and cost-cutting are creating a favorable platform for an earnings rebound. Extremely low interest and inflation rates will also facilitate a return to normalcy. Consequently, we believe that 2010 will bring a year of follow-up gains in the major benchmark equity indices, albeit at a much more moderate level than in the year that just ended. We are constructive on sectors such as transportation, technology, commodities and energy that are most leveraged to economic recovery and capital spending. We are also raising our overall direct and indirect non-dollar equity exposure to 50%.

We remain constructive on emerging market equities and cyclical commodity plays. With credit spreads stable and short-term interest rates near zero, we are selective buyers of higher-yielding foreign equity assets, especially in the BRIC sector. In the fixed income sector, we are currently neutral and remain holders of existing bond positions. Investment grade, high-yield and municipal bonds may not enjoy much capital appreciation in 2010 but clipping coupons in the high single-digits still delivers attractive risk-adjusted returns. In our opinion, the near-term prospects for long-dated Treasuries and the USD are dismal.

*****************

Institutional investors and most people who dwell within the peculiar and hermetic bubble known as Wall Street typically have a highly skewed perspective on the rest of the world. We were reminded of this recently when presented with the fact that only 5% of American households are actively involved in over 80% of the daily stock market trading in U.S. markets. (This, of course, excludes the vast middle class who have an indirect, passive involvement via their pensions and 401ks). This means that riveting and compelling questions such as market direction, asset allocation and risk management are largely the concerns of those who are already at or near the top of the economic pyramid. Everyone else is too preoccupied with either climbing that pyramid or simply staying in place. So if you are the typical, affluent client of a money manager or some large institutional wealth management firm, you should probably be engaged in the salutary process of “counting your blessings.”

This particular point of view is not unfamiliar to regular readers of this quarterly commentary, as I have been espousing the musings of the financial mind for some time. In The Mind of the Market (1999), I began the book with a soliloquy:

These days people often feel that their lives have fallen into an insidious trap.

Within their everyday worlds, they feel troubled by the incessant pressure to

sustain an economic livelihood for themselves and their families. And in this

realization they are indeed quite correct…..Speak to them of larger forces

that shape and buffet their private finances or go to the heart of their

economic well-being, and they become distant and uneasy spectators.

In recognition of the Darwinian and feckless nature of financial markets, our investing brain remains deeply divided. The typically dominant left hemisphere of most active investors is habitually grasping and manipulating, self-consciously speculating with myriad details of numbers and language, and hell bent on maximizing short-term gain. In contrast, the right hemisphere sees things in context and looks at the financial landscape in its totality. It looks at the endeavor of investing in a more nuanced, complex and longer-term way. In the battle for investment survival, we need to fully use both brain hemispheres to be simultaneously attuned to maximizing gain while minimizing loss. This is a concurrent and compatible exercise in cognitive dissonance that reminds us to look at investment performance not only quarter-to-quarter but also over the course of decades.

So for those who have been given much, what exactly should be expected? In brief, we should cultivate our garden, not only in the way Voltaire implied, but in a more expansive way to include those who enter into our constellation. This heightened sensitivity applies in both the secular and pecuniary realm. Within the world of investing, so much can and does go wrong, as the lost decade of 2000-2009 so haplessly attests to. Insofar as learning from the financial mistakes of the past, it is remarkable how little collective progress we have made. The sage H.L. Mencken explained it best when he said: “Error flows down the channel of history like some great stream of lava or infinitely lethargic glacier. It is the one relatively fixed thing in a world of chaos.”

As we go forth into the daily toil and mundane occupations that consume the vast majority of our lives, why not do so with a generosity of spirit, patience and empathy toward others that we ourselves would like to encounter in our own private materialistic strivings. Such a posture creates a space for change, an atmosphere of serenity that will help show you how the highest attainments are within reach. This is not only a decidedly profitable strategy but a most forgiving one as well. After all, a well cultivated garden not only produces the fruits of one’s labor but also provides intrinsic aesthetic pleasures as well.

Posted 10/06/2009

“Proverbs are short sentences

drawn from long experience.”

-Cervantes

The world equity indices turned in a strong 3rd quarter performance, following through on the rebound that began in Q2 as investors are heavily discounting a global recovery heading into 2010. While it is increasingly apparent that the recession is over, the debate now turns on whether the recovery will be L, V, U or even W-shaped. Although the macroeconomic issues of over-leverage, troubled assets, the weak dollar, consumer confidence and unemployment will take all of 2010 to work through, it is investor sentiment and the timing of the anticipated recovery that will drive stock market performance over the next few quarters.

International equities continue to outpace the broader US indices, reflecting the higher projected growth rates in China, India, Brazil and Southeast Asia. The return of risk-taking on the part of equity investors was accompanied by continued stabilization in the credit markets. In particular, the US corporate high-yield bond sector has been the optimal place to in 2009 YTD with a 49% total return through Q3, well outpacing other traditional global asset classes including even global equities. The high yield sector has more than recouped all of its losses since the financial crisis began, as capital appreciation and regular coupon payments contributed to very impressive performance. The broad commodities complex (bolstered by the falling dollar) also participated in the global recovery, shaking off the drubbing it took in 2008.

The operative question now is this: does the strong market performance of the last two quarters accurately assess a sustainable global recovery and reflation? Or have investors become too optimistic and too early in embracing risk assets again? The coming weekly trends in the major markets (especially in the historically ominous month of October) may tell us which side of the argument will win the day.

While not dismissive of the obvious risks, we remain constructive on emerging market equities and cyclical commodity plays. With credit spreads stabilizing and short-term interest rates near zero, U.S. investors remain buyers of higher-yielding foreign assets. Specifically, we overweight the BRIC sector, with China and Brazil leading the pack followed by India and Russia. The consumer markets in these countries show impressive resiliency as local consumer demand continues to grow. Although credit spreads have largely returned to pre-crisis levels, we are currently neutral on this sector and remain holders of existing fixed income positions. Investment grade, high-yield and selected municipal bonds, along with the precious metals complex of gold, silver and platinum provide a hedged and leavening effect on overall portfolio returns.

*****************

It has been ten years since the infamous publication of Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market, a best-selling book that was emblematic of the hubris and hysteria of the last stock market bubble (the Internet bubble of the late 1990s, that is, as distinguished from the more recent credit bubble of 2007-08). In September 1999, the DJIA was at 10,300 and many professional investors took this prediction seriously. Sadly, the current decade is on track to be the worst decade ever since the S&P index was formed in 1927. Now looking back after two market crashes, the Great Recession and a lost decade for most investors, what have we actually learned from this decade-long exercise in market futility? Do investors just repeat the same mistakes over and over again? More precisely, does a new generation of investors commit precisely the same follies just as the scars from the preceding market debacle fade from memory?

If past is indeed prologue, then the active investor must remind himself regularly of the following five lessons:

First, do not over-estimate long-term stock market returns. The traditional siren song about how “the market generates an average of 10% annual over the long term” has seduced countless numbers of entranced investors to part with their capital, only to be dashed upon the rocks of excess and ignorance. Market timing and volatility do matter in portfolio returns.

Second, the price of the securities you buy is crucial. Warren Buffet said it best: “Price is what you pay; value is what you get.” Sensible people would never dream of filling a cavity, writing software or giving themselves a physical exam unless they were trained to do so. Yet, it never ceases to amaze us how many otherwise intelligent people will wager much of their life savings in securities and in markets that they barely understand.

Third, be a patient and informed investor. Wall Street clichés such as “the train is leaving the station,” “put your money to work,” “cash is trash,” and “always put on tight stop-losses” are designed to make retail investors rush and worry. There are over 20,000 traded securities across world markets accessible to most investors every trading day, more than enough for even the most obsessive trader to pick the positions he wants, at the price he wants to pay.

Fourth, pay attention to inflation, the dollar and current income. For the last half-century, the dollar has been steadily losing its purchasing power. The rise of the emerging markets in the most recent decade (particularly the BRIC sector) will accelerate, exacerbating this dismal trend. Give appropriate priority to dividends and other forms of current income, as they historically constitute a very important part of total return. Finally, make sure that at least 25% of your total portfolio has direct or indirect non-US dollar exposure.

Fifth, be very skeptical of market “experts” and pundits. Talk is cheap, so is the written word, especially in an age of 24/7 cacophony that envelopes us like locusts descending upon the fruitful plains. A case in point, the two co-authors of Dow 36,000, best known for their nescient book, continue to gainfully ply their trade: James K. Glassman is chairman of an independent federal agency and a personal finance columnist; Kevin A. Hassett is a senior fellow at the prestigious American Enterprise Institute. Alas, the free market can be very forgiving.”

Posted 07/06/2009

“Let those who have abundance remember that they are surrounded

with thorns, and let them take great care not be pricked by them.”

-John Calvin

The Really Important Stress Test……First, the good news. After six straight consecutive quarterly losses for risk assets worldwide, equity-oriented indices tallied strong gains for the second quarter of 2009. Now for a dose of sobriety: lingering fundamental economic challenges remain as the major economies try to recover from the aftermath of the bursting of the asset and credit bubbles. The investor who went into deep slumber on New Year’s Eve would have woken up at the mid–year point thinking that very little had changed during the preceding six months. In fact, he would have missed the Armageddon-like terror in early March as markets plunged a further 25% into the abyss, only to be followed by a phoenix-like rebound that brought the U.S. YTD totals to a largely unchanged level. Whether one feels relief, optimism or skepticism is a primarily a function of temperament, time horizon and market conviction.

In the first half of 2009, the federal government put the major American banks through rigorous “stress tests” that purported to measure the capital adequacy of these financial institutions in a variety of presumably stressful economic scenarios. The resulting disclosure that many large banks needed to raise additional capital was the culmination of an anti-climactic series of mea culpas by the very financial and banking institutions that inflicted such staggering losses on investors and the economy at large.

While the bank stress tests seem to validate that the financial crisis of 2007-2009 might finally be nearing its conclusion, they also offer a cautionary tale for professional and lay investors who endured the trauma and financial carnage of the Great Recession. We have all been affected by the market turbulence of the past two years. It seems natural to ask why the investment process failed most investors around the globe and what the crisis teaches us about the effort to rebuild wealth. Financially and emotionally, many investors have re-examined their portfolios, adjusted their asset allocations and even made fundamental changes in their lives. With the markets as notoriously feckless as ever, the concepts of diversification, risk tolerance and liquidity have become much more than abstract concepts; they are the daily touchstones of active investors.

Having survived the greatest investing challenges in our lifetime, may I presume to ask as to how you performed in the stress test that really counts? Ask yourself the following five questions:

- Were you forced to liquidate any significant investments in order to meet near-term liabilities?

- Did you experience recurring episodes of fear, panic and anger caused by the reduction in financial net worth or sense of security?

- Did you suffer any sustained adverse physical or psychological effects from the prospect of significant financial loss?

- In the exuberance of a bull market, did you forsake the fundamental principles of investing such as prudent diversification, due diligence, liquidity and risk management?

- Did you adversely alter or terminate any valued long-term relationships as a result of the volatility and anxieties of investing during a prolonged financial panic?

If the answers to any of the above questions were yes, then perhaps you were not managing your investment activities with the “margin of safety” and perspective that a diligent, prudent investor must have in order to survive and prosper in the complex, unpredictable environment that professional investors confront on a daily basis.

So often a model of monumental ineptitude, Washington is currently embracing many of the Keynesian notions of economic recovery that were fashionable in the aftermath of the Great Depression: high government spending, deficits, subsidies, regulation and the profligate printing of money. The historical evidence suggests that Keynes was a much better investor than an economist; and some of his investment rules have never been more salient that at the current moment. They include: 1) “Markets can remain irrational longer than you can remain solvent,” “Successful investing is anticipating the anticipations of others,” and (perhaps most importantly) “In the long run we are all dead.” In the aftermath of crisis, let us remind ourselves of these insights as we position our portfolios for the expected recovery ahead.

To the global investor, it is becoming more apparent each year that the U.S. is relinquishing its vanguard status to the faster growing emerging markets of China, India, Latin America and the Pacific Basin. Nevertheless, in a world of risk and uncertainty, America blue chip stocks, Treasury securities and even the much maligned dollar still enjoy a safe-haven status no other nation can yet rival. For investors seeking growth and diversification, we continue to believe that approximately half of equity-oriented assets should have international exposure. Within sectors, we overweight energy, utilities, high-dividend stocks, precious metals and other defensive industries. For fixed-income investors, investment grade, high yield and municipal bonds still offer favorable risk-adjusted returns.

The markets are currently struggling for direction, although broad valuations seem generally on the mark. Given such a backdrop, we anticipate a Q3 of largely jagged sideways action, with a modest upward bias. Using a blackjack metaphor, we plan to continue making timely bets, carefully protect our chips, and keep a close eye on both the dealer and the players. As Warren Buffett puts it: “What the wise man does in the beginning, the fool does in the end.”

Posted 04/01/2009

“It’s a troublesome world. All the people who’re in it

are troubled with troubles almost every minute.

You ought to be thankful, a whole heaping lot,

for the people and places you’re lucky you’re not.”

-Dr. Seuss (Did I Ever Tell You How Lucky You Are?)

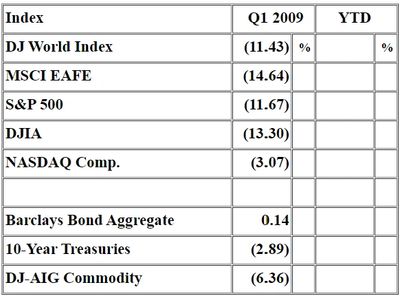

Investing While Under the Influence…..of Panic. At the recent market lows of March 9, 2009, global stock markets hit their lowest levels since 1997, thereby erasing more than a decade of gains in just 16 months. A strong rebound in late March still left the S&P 500 11.7% below the beginning of 2009, though a marked improvement from the negative 26% plumbed just three weeks earlier. Nevertheless, Q1 was the sixth consecutive quarterly decline since the Dow hit its all-time high in October 2007. The equity markets have not had such a long losing streak since June 1970.

The daily drumbeat of dour economic and market headlines makes investors of a certain age recall the song lyric “…..been down so long it looks like up to me.” It is understandable that investors are questioning the viability of long term investing as well as all the conventional wisdom typically proffered by the pundits, for whom words are indeed cheap. As the crisis moves inexorably towards a bear market climax, more and more reasonable people begin to anticipate Armageddon and embrace a despairing inertia. Investing is ultimately simple: too much market exposure will fill you with regret, and too little market exposure will leave you arguably poorer. What should the thoughtful, prudent investor do?

Is this just a Great Recession or something much worse? While investors may be haunted by the specter of the Great Depression, portfolio managers compulsively seek investment opportunities regardless of the direction of any particular market. This is driven not so much by fiduciary obligation as it is by career risk. In the most volatile environment in our lifetime where most global markets have become highly correlated, this means scouring the world for mispriced assets and other opportunities far beyond the bounds of equities. This posits taking positions in many different markets including various segments of the fixed income, commodities, currencies and derivatives markets. In investing terms, if beta is the return from the major market indices, then alpha is the manager’s return in excess of beta, as adjusted for the same level of risk Over time, this is why you pay your investment advisor.

Investment managers seek a positive return by exploiting market opportunities while protecting principal from unrecoverable losses. The promise of positive returns (or at least relative outperformance) in a secular bear market lies not in identifying any single “right bet” but by being positioned in several different, reliable trends while avoiding any major catastrophes. This is the so-called “secret sauce.” The bottom line is that asset class selection and overall timing is crucial. Of course this is not easy to do (if it was, everyone would do it). Market prescience is both an illusion and a fatuous vanity. One must be careful not to confuse high portfolio turnover with market insight, or conversely, an overweight cash position with passivity. Sometimes staying on the sidelines is the best course of action.

In the current unsettled environment, this translates into a portfolio heavy in cash, with the balance allocated towards intermediate-term Treasuries, investment grade bonds, high yield bonds, and municipal bonds. High-yielding equities, precious metals and energy-related companies also provide the potential for outperformance with a manageable level of risk. Brazil, China and other selected Asian markets are also exhibiting resiliency. Every directional bet – long or short - represents a discrete probability and needs to be reassessed and modified on an ongoing basis. We must have both the confidence to take those positions, combined with the humility to change our minds on short notice. For us, this approach is neither a relaxed nor a necessarily happy posture; however, it does make our clients’ portfolios transparent and intellectually rigorous. As is so often the case, dawn appears just when darkness seems interminable. Hopefully, the results – the alpha - will justify all the effort and anxiety.

In conclusion, amidst these tumultuous times, I find solace in the faith of the Stoics whose teachings prescribe an astringent tonic for a global marketplace that too eagerly submitted to the reign of its impulses. Stoicism is a philosophy that counsels self-control and a radical indifference to the materialistic world. Now such a philosophy may ostensibly seem absurd when applied to investment managers in never-ending pursuit of the “filthy lucre;” but Marcus Aurelius’ Meditations and Epictetus’ Handbook hold particular appeal for portfolio managers in need of self-control. We can all be fortified by reminders to ourselves not to be casualties of our ambition, to accept fate and to shoulder the burdens of our fiduciary responsibilities. While one may not choose to become an ascetic or to renounce worldly aspirations, Marcus Aurelius is a voice for these times when he writes; “The entire earth is but a piece of dust blowing through the firmament. In such a grand space, how many do you think will think of you?”

Posted 01/05/2009

“Whatever you do will be wrong, including doing nothing.”

-Henry Kissinger (in reference to diplomacy in the Balkans)

The Broken Lighthouse…..During 2008, investors who relied on traditional paradigms to guide their investment decisions were confounded by an environment where fundamentals seemingly became irrelevant. Value was replaced by sheer panic. Like a ship’s captain who could no longer trust his navigation instruments or any familiar reference points, the vessel was cast adrift on the high seas, relying only upon dead reckoning in search of safe haven.

Alas, this is not the end of the world, or even the end of human nature. Panic and depression are the extreme manifestations of the primal human emotions brought about by the devastating bear market of 2008. It is a rational and wholly predictable reaction to the market maelstrom that enveloped the globe and decimated the investible assets of institutions, governments and individuals by 40-50% or more. Fear is a natural consequence of “the battle for investment survival” – to reference a classic 1935 investment book of the same name.

By the end of the dismal year, the DJ World Equity Index was down 42.9%, the S&P 500 down 38.5% and the DJ-AIG Commodity Index down 36.6%. Karl Marx, ironically capturing the euphoria and agony of financial bubbles and meltdowns, wrote in Das Kapital: “Everyone knows that some time or other the crash must come, but everyone hopes that it may fall on the head of his neighbor, after he himself has caught the shower of gold and placed it in safety.” Only the most prescient and defensive investors were spared the most painful blows.

The worst market crash since the Great Depression was the first in which product diversification offered no protection because every geographic market and asset class (except U.S. Treasuries and gold) suffered precipitous price declines. This by no means discredits the concept of diversification. It simply demonstrates that in a highly connected global financial system, extreme fluctuations in asset values along with imprudent use of leverage can overwhelm the underlying financial infrastructure. A global bear market meltdown in investible assets can also undermine the psyche of the investor class, from the elite investment vehicles of the rich to the mass-market institutions of the broad middle classes. This financial crisis has shown that history provides unreliable guidance for projecting future losses. Computer models based on historical experience cannot incorporate the many systemic and idiosyncratic changes that propel investor and consumer behavior.

Small retail investors know it’s a terrible market when their equity mutual funds are showing losses for the year of over -20% but are still being ranked in the top 1% of the industry. Traditional investors in staid bond funds who normally expect standard deviations of only a few points in their returns were rocked by equity-like volatility, especially in corporate investment grade and high yield bonds where spreads over Treasuries reached all-time highs. The hedge fund industry suffered its worst year on record, with median hedge fund performance down 25%. For those who have not yet realized the misnomer, hedge funds actually do precious little hedging but were in fact super-charged leveraged speculation machines, not too unlike their more institutionalized investment banking brethren. And so it goes…..

It is the end of an era. From 1980-2008, a secular, super bull market was dominated by investment bankers and traders; now they not only face job loss but also a profession changed beyond recognition. It would be unseemly to pile on, so a Bob Dylan dirge is more fitting:

All these people that you mention

Yes, I know them, they’re quite lame

I had to rearrange their faces

And give them all another name

Right now I can’t read too good

Don’t send me no more letters no

Not unless you mail them

From Desolation Row.

As we recover from the shocks of 2008 and reassess an altered investment landscape, the following may help investors reposition themselves for what lies ahead:

- Be skeptical of investment advisors but also be a little forgiving. Predicting market trends is a notoriously difficult and feckless business. Even the most respected and successful money managers stumbled badly in 2008. Judge your investment manager by his or her long-term track record, level of service and quality of advice.

- Diversification really works. A careful system of asset allocation may not guarantee avoidance of investment losses, but it should moderate the extreme volatility that investors find so disturbing.

- Avoid leverage except in speculative trading accounts. Stocks, many classes of bonds, commodities, currencies and virtually all hard assets carry embedded degrees of risk, volatility and illiquidity. That is why they are referred to as “risk assets.” Do not compound these risks by adding leverage into the equation.

- Keep investments strategies simple and based on a compelling investment rationale. Being informed and doing due diligence not only minimizes the probability of making “stupid” investment decisions, it also provides the conviction to guide the portfolio during the turmoil of bear markets. The current market valuations for many stocks, certain bond classes and hard assets are now the lowest in a generation, providing attractive entry points for astute, patient investors.

- Flexibility and humility are crucial qualities of portfolio management. The capacity to concede mistakes, change course and challenge conventional wisdom is a form of market intelligence that is under-rated and increasingly scarce. The aphorism that “markets can stay irrational longer than one can stay solvent” reminds us all of the limitations of our knowledge and control.

As we conclude a difficult 2008 and look forward to a better 2009, let us not forget why we invest at all. The market shows us sobering lessons and inspirational ones. It shows us our capacity for extraordinary effort and willing self-delusion. It reveals to us the full spectrum of our human nature: the greed and fear, the hubris and regret, the unforgiving calculus of open competition, and the sweet logic of reason. The purpose of investment should bring us closer to serenity. As Voltaire’s Candide once suggested: “Let us take care of our happiness, go into the garden and work.”

Posted 10/01/2008

George Soros: “Why do you bother going to work every day? Why not go to

to work only on days when there is something to do?”

Byron Wien: “George, one of the differences between you and me is that

you know when those days are, and I don’t.”

The Demise of Fast Money….. It’s tough these days to be a patient, fundamental investor To be an active investor, one almost needs to adopt the persona of a market speculator. If your positions rise in value, it is advisable to nimbly take profits; if losses mount, cut your losses quickly and come back to the gaming tables another day.

The distinguishing feature of the current global financial crisis is its unpredictable surges, followed by ruinous declines. There is no rhyme or reason, and often no rational explanations are forthcoming. The market is up in the morning and then falls back in the afternoon; or it is down in the morning, only to rebound before the end of the day. There have even been days when both scenarios have occurred during the same trading session. These heart pounding swings are not about fundamentals; they are about market sentiment. With due respect to Warren Buffet whose preferred holding period for favored stocks is “forever”, it is not in the nature of mere mortals to sit calmly when our hard-earned nest eggs are visibly shrinking before our eyes.

The famous Wall St. adage: “Sell in May and go away!” has been the best investment advice for 2008. It suggests that investors buy at the end of November and sell at the end of May, thus avoiding both the summer doldrums and the dangerous months of September and October where many crashes have been concentrated. This year, from 5/30/08 – 9/30/08, the S&P 500 Index declined 17 % while the international EAFE Index fell 24%. It is a mystery as to why September and October are historically such miserable months for investors, or why the December–May period have a disproportionate impact on investor returns. But when large amounts of money are at stake, superstition and gut instinct seem to hold as much sway as rational analysis and computer risk models.

Market volatility in the 3rd quarter of 2008 continued at unprecedented high levels. The recent collapse of major financial institutions, the gyrating price of oil, and a looming global recession have transformed Wall St. into a Dylanesque Desolation Row. Against this background, perhaps the most compelling explanation is that global markets have devolved into an intricately related series of speculative financial casinos. Although the $2 trillion, hubris-laden hedge fund industry attracts most of the blame, many mainstream institutional investors are equally culpable of chasing the latest trends in search of short-term performance.

The rise and fall of natural gas exemplifies what happened with so many trendy investment ideas during 2008. Natural gas prices soared by 80% in the first half of 2008. This parabolic rise was followed by a complete reversal within only two months! Since July, natural gas dropped from $13.50 per million British thermal units (MMbtu) to $7.00 /MMbtu. In January, the initial price surge was driven by rising crude oil prices. Its relatively cheap price compared to oil spurred industrial demand. As prices rose, onshore natural gas drilling increased significantly, eventually leading to strong supply and high inventory levels. Alas, cheap $7.00 natural gas discourages drilling and dampens supply. When economic activity resumes in 2009 and 2010, natural gas prices should recover accordingly. Short-term weather-related factors and market speculation masked the underlying supply/demand situation and magnified the price swings, but they did not change the fundamental cyclical nature of this crucial commodity. Is it conspiratorial price-fixing or rapacious hedge fund speculators that caused these volatile price movements? Just blame the usual culprits: supply and demand, along with the distinctly visible hand of greed and fear!

Why do investors always promise prudent risk avoidance only after the fall? Of course it is easier to track the downward trajectory of the global financial crisis than to avoid its unpleasant repercussions. What began as a crisis confined to certain obscure sectors of the bond markets has now severely shaken investor confidence in the stability of mainstream financial institutions. More importantly, it is threatening the entire U.S. economy in which cumulative international imbalances and over-exuberant pricing of all investment assets are now being dramatically corrected. We are facing a synchronized downturn across most developed economies which is, in turn, affecting growth in China, Brazil, India and Southeast Asia.

In the U.S., the phenomenon of sharply lower personal net worth, job insecurity and the evaporation of consumer credit all add to the risks of a prolonged recession. The anticipated decline in corporate earnings and the wholesale liquidation of hedge fund assets is likely to weigh on investor sentiment for at least the next two quarters. It is unlikely that equity prices or credit spread risk premiums have reached their worst levels. For the balance of the year, we will maintain a tactically defensive posture, with selective new investments in recession-resistant sectors. In the current investing environment, volatility and risk aversion remain high, but volatile markets can quickly reverse. Amid the carnage, world-class businesses with bargain-basement valuations are emerging for those investors with ready cash and strong convictions. We will wait patiently for the coming of an optimal re-entry point.

Here’s what investors with substantial investment assets should be doing now: 1) maintain an ample supply of cash (but be careful which banks you are keeping it in), 2) stay diversified so that the crash of any single position or sector will not ruin your life, 3) avoid illiquid investments that cannot be sold quickly, and 4) invest only in positions you understand and can follow reliably. Bear markets always return stocks (and bonds, commodities, real estate, etc.) back to their rightful owners. Preserve your capital and wait for the cycle to turn, as it inevitably will. If you are losing sleep over your portfolio, you have too much risk assets in the market. For those smaller investors who dream about a large investment portfolio in the future: be careful of what you wish for!

Posted 07/02/2008

“The man whose whole life is spent in performing

a few simple operations…generally becomes as stupid

and ignorant as it is possible for a human creature to become.”

-Adam Smith

The Wealth of Nations (1776)

An Imperial Retreat…..We have seen Adam Smith’s astute observation played out countless times, most recently by America’s esteemed politicians as they lurch their way through a very long political season, and also by our financial moguls on Wall Street as they sift through the rubble of our current credit crisis.

This week, my 15-year old daughter asked me why the markets have been under such selling pressure during the past year. Since she is an academically bright student but with an insufficient grounding in economics and current events, I felt obligated to give her a thoughtful answer. Predictably, I offered up the conventional bromides as to what has been ailing our financial markets: the catastrophic bursting of the real estate and credit bubbles, sky-high energy prices, commodity inflation, the US dollar at an all-time low, spiraling budget and trade deficits, permanent government gridlock in Washington, etc. Although she quickly seemed to grasp the magnitude of these systemic, intractable problems, I nevertheless had the nagging sense that she – not unlike most lay observers of the market – still didn’t get it. The problem with academic, conventional explanations to a complicated question is not that they are wrong; it is that they do not resonate within the popular mind and thereby fail to ignite any real change in behavior.

Shortly after the kitchen table seminar with my daughter, I came across a better explanation by Bill Gross of PIMCO as to why the investment outlook for the U.S. markets should make our political and business leaders take pause. The following is an excerpt from Gross’ commentary:

We have for so long now been willing to be entertained rather than informed, that we

more or less accept majority opinion perpetually shaped by ratings obsessed media at

face value…..We care more about who is going to be eliminated from this week’s American

Idol than the deteriorating quality of our healthcare system. Alternative energy discussions

take a bleacher seat to the latest foibles of Lindsay Lohan or Britney Spears and then we

wonder why gas is four bucks a gallon. We care as much as we always have – we just care

about the wrong things.

It’s Sunday afternoon at the Coliseum folks, and all good fun, but the hordes are headed for

modern day Rome – better educated, harder working and willing to sacrifice today for a

better tomorrow. Can it be any wonder that an estimated 1% of America’s wealth migrates

into foreign hands every year? We, as a people, are overweight, poorly educated, over-

indulged, and imbued with such a sense of self importance on a geopolitical scale that our

allies are dropping like flies.

Are we experiencing the twenty-first century American version of the decline of empire that befell the English in the previous century? The British Empire at its dazzling climax - the Diamond Jubilee of Queen Victoria in 1897 London – was a celebration of imperial strength, unity and splendor. We saw the British at the height of their vigor and self satisfaction, imposing their traditions and tastes on diverse peoples of the world. From that historical peak of empire, the world then bore witness to an extended decline that played out for much of the twentieth century. Symbolically, the pound sterling – which once occupied the role as the world’s reserve currency – took 80 years to decline from peak to trough against the world’s basket of currencies. Alas, is the United States in a similar state of imperial retreat?

What historically made America’s free market system the gold standard of the world was based upon a Puritan moral culture with regards to money. Americans have always admired Ben Franklin’s example of industriousness, moderation and parsimony. In recent times, a financially decadent and corrupt mentality has taken over, creating in America what the New York Times columnist David Brooks has described as a polarized society consisting of, at each end, the investor class and the lottery class.

The investor class focuses on tax-deferred savings and other tools of long-term financial prosperity. They practice the gospel as espoused by the “first great American,” the author of Poor Richard’s Almanac. In stark contrast, the lottery class is preoccupied with the next payday, credit cards and winning lottery schemes. Approximately 20% of Americans are frequent lottery players, spending $60 billion a year. The poorer the household, the higher the percentage spent on lotteries, gambling and other similar vices. We can’t wait. We want something for nothing. Besides the financial toll, there is a moral toll as well, most eloquently described as a tax on stupidity. What should we do? There are many solutions but none of them are easy or quick. They all require a fundamental change in values and priorities. Can America transform itself once again to face the demands of a new era?

My favorite aphorism about the financial markets is: “If you don’t know who you are, the market is an expensive place to find out.” The first half of 2008 has borne out this warning. Wall Street - and its counterparts in London, Shanghai and Mumbai - serve as expensive universities for a willing investment public. They welcome a perpetual stream of students who pay tuition to get educated. So far in 2008, the price has been high. Markets ebb and flow, but the beauty of our free market system is that it allows our best and brightest to seek their fortunes, while letting the rest of us be as dumb as we wanna be.

*****

After a miserable Q1 in 2008, a brief but strong market rally in April made traders think that it was safe to get back in the water. But the 2007 Summer credit crisis inconveniently would not be contained and its contagious repercussions has now spread throughout the larger economy, casting a pall on most trading markets for the balance of 2008. The DJIA turned in its worst June performance since 1930, and the downward velocity of most international indices augurs a very challenging environment for the second half of the year. While the recession in the US economy is well known, the steadily contracting growth rates in the EAFE economies, soaring inflation rates especially in the BRIC markets of 6 – 15%, and shaky banking institutions worldwide all point to an imminent widespread slowdown. The bright spots on the investment horizon remain the energy, commodities and precious metal sectors; while the financial, real estate and consumer sectors may still have not seen the worst of this market downturn. Large and resource rich countries such as Brazil, Canada, and Russia continue to provide interesting opportunities to reallocate capital. As for bonds, even with US money market returns at only 2%, most sectors of the fixed income markets offer decidedly unattractive risk-adjusted returns. In this kind of environment, maintaining a high level of liquidity and carefully staking out selected long-term investment positions are the best ways to ride out the current market turbulence.

Posted 04/01/2008

In 1720, Sir Issac Newton was wiped out in a

stock market crash, blazing a trail of financial failure

that geniuses have been following ever since.

“It’s all right, Ma, I’m only bleeding”…Market pundits typically declare that the sure sign of a market bottom is “when nothing works and there is no place to hide.” If there is truth in that conventional wisdom, then the end of Q1 2008 was – if not the bottom – then a bottom. Throughout the quarter, we saw a rolling capitulation from financials to small caps to emerging markets to the US dollar to most fixed income classes to, finally, commodities and precious metals. This serial capitulation was compounded by the bi-polar nature of day-to-day market swings that could best be described as paranoid schizophrenic. The result was the worst quarter since Q2 2002. Market volatility (as measured by daily changes in the S&P index) reached a 70-year high. Sometimes it seemed hard to know whether one should laugh or cry. In one of the more volatile weeks in late March, it became clear to this market observer that the prevailing paradigms and models normally used to understand current market action was suspended for the time being. In other words, for recent readers of my quarterly commentaries, this was definitely a quarter of “black swans.”

Sometimes in recessions and bear markets, the most judicious thing to do is hoard cash, stay defensive and wait out the storm. It is not easy for active trader types to do very little; we always think we can find some angle to profit from. But to take a contrarian view, it does require a not inconsiderable amount of market conviction and self-esteem to hold one’s ground, even when market pricing fails to provide any near-term positive affirmation. One of the consolations for avid students of financial history is the knowledge that while historical events per se may not repeat themselves, they do rhyme. We have now seen the poetic repetition of the 1990-91 recession and the 1998 Long Term Capital Management credit debacle. However, in both instances, the major market indices rebounded strongly in the subsequent year. For the optimistic minded, significant rallies can and do occur even during bear markets.

During periods of sustained turbulence, investors are well served to go back to basics, especially with regards to how we make our mistakes. The following is courtesy of Jason Zweig’s Your Money and Your Brain:

Hubris: we overestimate our odds of success and take excessive risks.

Home bias: we invest too much in what we know (our employer’s stock) and too

little beyond our circumscribed world.

Illusion of control: we overstate our power to influence our circumstances.

Hindsight bias: we rationalize past unforeseen events, preventing us from learning from mistakes.

Self-ignorance: we are even overconfident about our capacity to overcome our overconfidence.

Market volatility should continue in the upcoming quarter, especially in the financial sector. The US economy is moving sideways at best while overseas growth is definitely slowing. The good news is that equity valuations are now very reasonable and fundamental strength in China, India, Brazil and Southeast Asia (coupled with a weakening dollar) will benefit most US multinationals. We have seen better, but certainly worse as well. As Dylan suggests: “Don’t think twice… It’s all right.”

Posted 01/03/2008

“You got to be very careful if you don’t know where you are going,

because you might not get there.”

- Yogi Berra

A Tumultuous 4 th Quarter….and Year Ends, But Holding On To Gains. It is very hard to anticipate short-term changes. It is even harder to let unpredictability into one’s financial life and profit from it. But that is precisely our job: to invest in information and preparation, so that the next market problem can yield a subsequent market opportunity.

The year just ended was not for the faint of heart or weak of stomach. The national housing market is mired in its deepest slump since the 1930s. The U.S. dollar is at historic lows versus most other currencies. The credit and mortgage markets are dealing with the kind of severe dislocations and write-offs that equals and will probably surpass both the 1997-98 emerging market debt crisis and the leveraged loan crisis of the early 1990s. But the most shocking event of 2007 was the gradual but incontrovertible realization that the smartest of the so-called smart money (the hedge funds and the Wall St. bond trading desks) can be just as clueless as the great unwashed. Only some were clever enough to sell their over-priced positions to you before the bottom fell out.

While it is clear that the consequences of “mark-to-myth” structured debt, covenant-lite leveraged loans, and no-down payment mortgages will take much of 2008 to work its way out of the system, there were nevertheless some encouraging developments. The strong momentum in the energy and basic materials complex offset much of the weakness in the real estate and financial sectors. Economic growth in Asia and South America remain robust even as recession threatens the American landscape. Even technology staged a surprisingly vibrant rebound.

Despite a dispiriting 4 th quarter, most equity indices managed to squeeze out moderate gains for the year. Bonds (particularly Treasuries) were unloved for the first half of 2007 but benefited from the flight-to-quality hysteria that broke out in July / August and then once again in November. In international markets, Brazil–Russia–India-China once more led the pack although both the Indian and Chinese markets now look increasingly over-extended.

In 2008, energy, utilities, food commodities, and precious metals continue to promise further strength. I remain skeptical of most consumer-related sectors and patiently await bottom-fishing opportunities in real estate and the financials sometime during the year. The financial situation of the average American middle class family remains precarious. I continue to over-weight international markets and under-weight U.S. equities and U.S. bonds. Many aspects of the BRIC story still seem compelling although the ghosts of bubbles past lurk near enough to mitigate too much over-exuberance.

In sum, the markets exhibit an impressive capacity to absorb bad news and still adjust to new areas of growth. In this aspect, it behaves like an adult in the prime of middle age, humbled by past mistakes but now wise enough to distinguish ephemeral seductions from more lasting pleasures.

Posted 10/15/2007

"When you wake up in the morning, Pooh," said Piglet at last

"what's the first thing you say to yourself?"

"What's for breakfast? said Pooh. "What do you say, Piglet?"

"I say, I wonder what's going to happen exciting today? said Piglet.

Pooh nodded thoughtfully. "It's the same thing," he said.

- A. A. Milne

Markets Remain Resilient in Face of Summer Credit Meltdown: Conviction or Wishful Thinking? In late July, when the subprime mortgage crisis started an overall global credit crisis, I believed that we were faced with a containable near-term problem. Although the implications for the major trading markets would be severe, it would not lead to a sustained contagion and normality would return by the end of the quarter. While it is still a bit early to see if that is indeed the case, investors who stayed the course and did not engage in panic selling are looking at reasonable gains going into the final quarter.

The U.S. economy is certainly slowing down and acting like a recession may be around the corner but the rest of the world seems upbeat. European fundamentals remain relatively attractive while the BRIC juggernaut (Brazil, Russia, India, China) is giving the so-called First World a long-awaited comeuppance. There are still numerous seductive investment opportunities in these high-profile markets; whether they represent good long-term positions or are simply good trades is subject to much debate. In particular, the moonshot that is the Chinese market is entrancing investors with a combination of fascination, fear and disbelief. Everyone (including yours truly) is watching China’s coming out party leading up to the 2008 Olympics.

In the last quarterly report, I referred to Nassim Taleb’s The Black Swan , a revelatory new book about the impact of highly improbable historical events He suggested compelling lessons for those who work in the world of risk, uncertainty and randomness. I have since read his other ground-breaking work Fooled by Randomness , wherein he describes the hidden role of chance in life and in the markets. Some of my favorite sections of the book are the profiles of current and former Wall St. masters of the universe, who achieved great fame and fortune or downfalls. Many of the profiles seemed familiar to me. The main question he poses is this: did they get to where they are because they are so smart, or because they were lucky enough to be there when it was happening?